Vecima Reports Q4 And Year-End Fiscal 2021 Results – Record-Breaking Consolidated And DAA Revenues

-

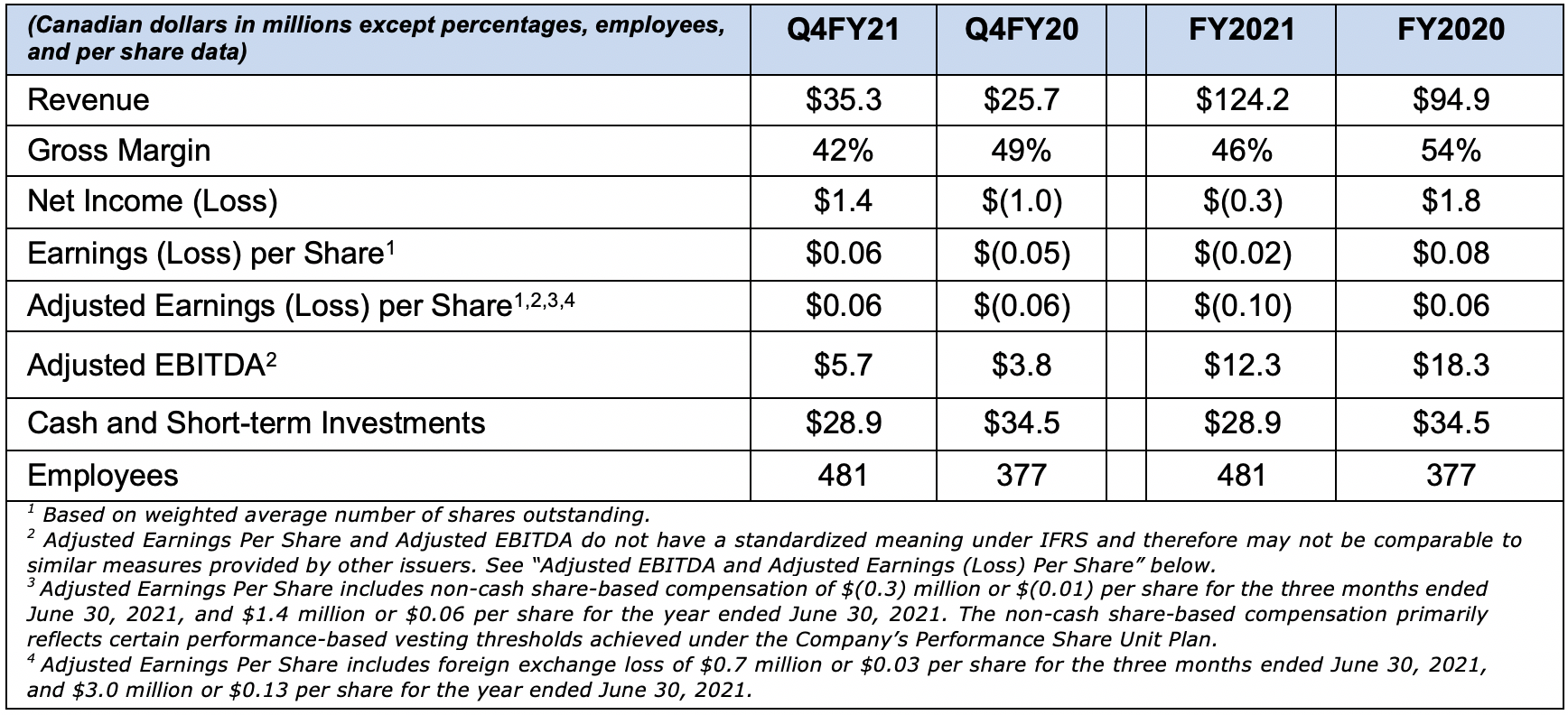

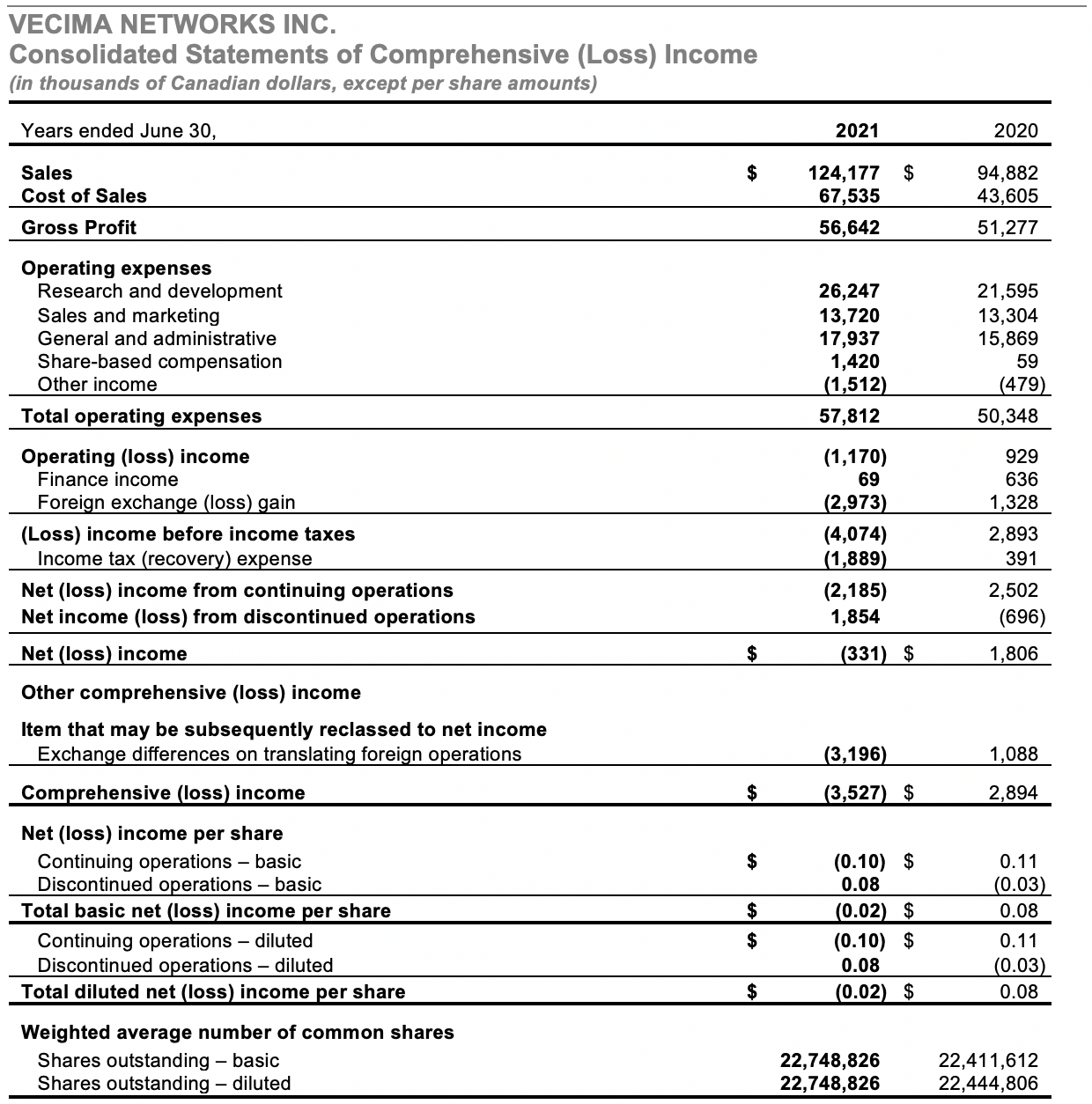

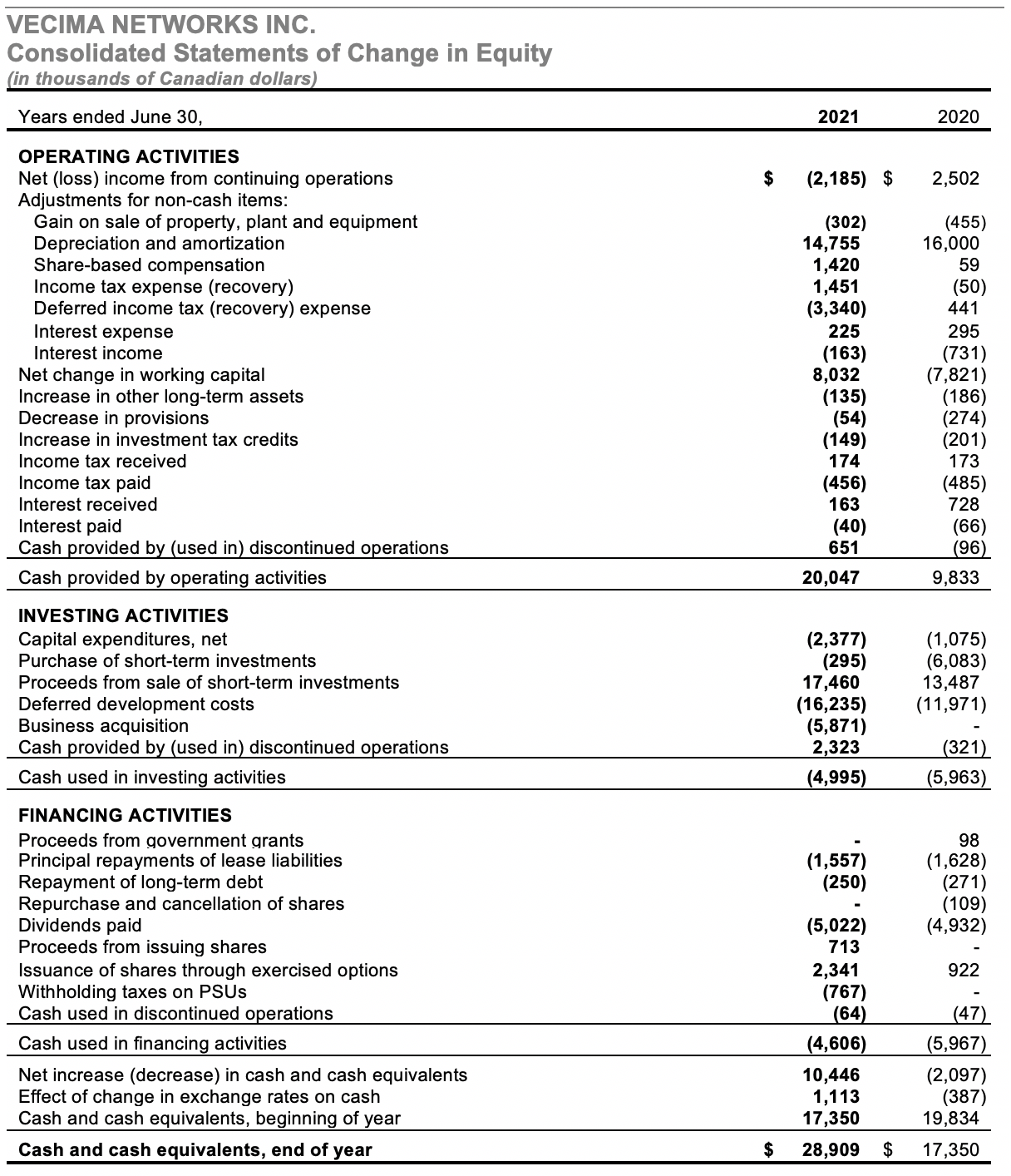

FY2021 Revenue: $124.2M (up 31%), Gross Margin: 46%, Cash Balance: $28.9M

-

Generated full-year Adjusted EBITDA of $12.3M and grew Q4 Adjusted EBITDA to $5.7 million (up 189% QoQ)

-

QoQ revenue growth averaged close to 10% during Fiscal 2021

-

Achieved significant FY2021 Video and Broadband Solutions growth, with segment revenue increasing 110% to $75.3M and segment gross profit growing 87% to $31.6M YoY

-

Next-generation Entra family DAA sales climbed 7x YoY to $42.6M, including sales of $16.6M in Q4

VICTORIA, BC – (September 23, 2021) – Vecima Networks Inc. (TSX: VCM) today reported financial results for the three months and year ended June 30, 2021.

FINANCIAL HIGHLIGHTS

“Fiscal 2021 proved to be the breakout year we have long envisioned, with our leading products capturing the first wave of our industry’s widescale migration to distributed access architecture or DAA,” said Sumit Kumar, Vecima’s President and Chief Executive Officer. “By virtue of multiple years of investment, innovation, and persistence, Vecima has emerged as a global industry leader in the rapidly growing DAA market. We now boast the industry’s single strongest portfolio of high-speed data access network products for cable and fiber, a large and rapidly growing global base of Tier 1, 2, and 3 customers, and financial results that have started to reflect our momentum. This is only the beginning.”

“I am very proud to report that fiscal 2021 represented the single highest year for sales in Vecima’s 33-year history, with annual revenues climbing 31% to $124.2 million and fourth quarter sales increasing 37% to $35.3 million year-over-year,” added Mr. Kumar. “These results were driven in large part by the tremendous momentum in our Entra portfolio as we support several of the world’s largest cable operators in their transition to DAA for the networks of the future. Our record results also underscore the resounding success of our acquisition of Nokia’s cable portfolio of market-ready Remote MAC-PHY, access controller, and 10G FTTH products, which further accelerated results from our Entra portfolio in fiscal 2021. As a result, our growth in the DAA market grew sequentially quarter-over-quarter through the entire year, culminating in full-year Entra sales of $42.6 million, seven times higher than fiscal 2020.”

“This, in turn, drove a very strong year for our broader Video and Broadband Solutions segment, which also benefited from growing demand for our Terrace family of hospitality industry commercial video platforms, even as customers began the shift to our next-generation solutions.”

“Importantly, we achieved these results against the backdrop of the COVID-19 pandemic which has created challenges across our industry and many others. In our Content Delivery and Storage segment, COVID-19 restrictions at some of our customers’ operations slowed their ability to integrate and expand the record new business wins of the prior year, constraining this segment’s growth in fiscal 2021. Global supply chain tightness also delayed some product lead times and weighed on our fiscal 2021 gross profit margin. We have continued to focus on managing these industry challenges strategically, including leveraging our very strong balance sheet and excellent supplier relationships to increase inventory levels.”

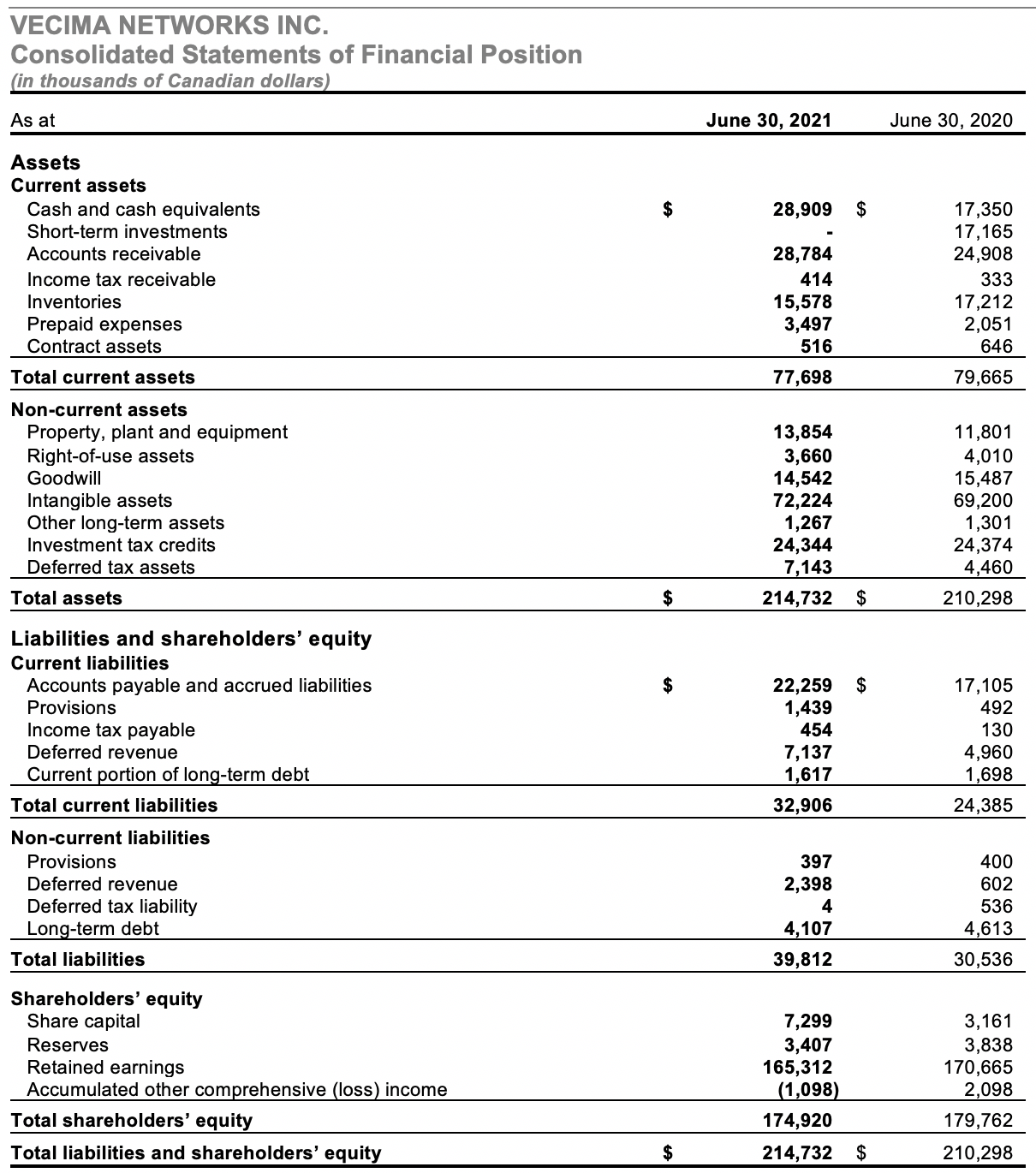

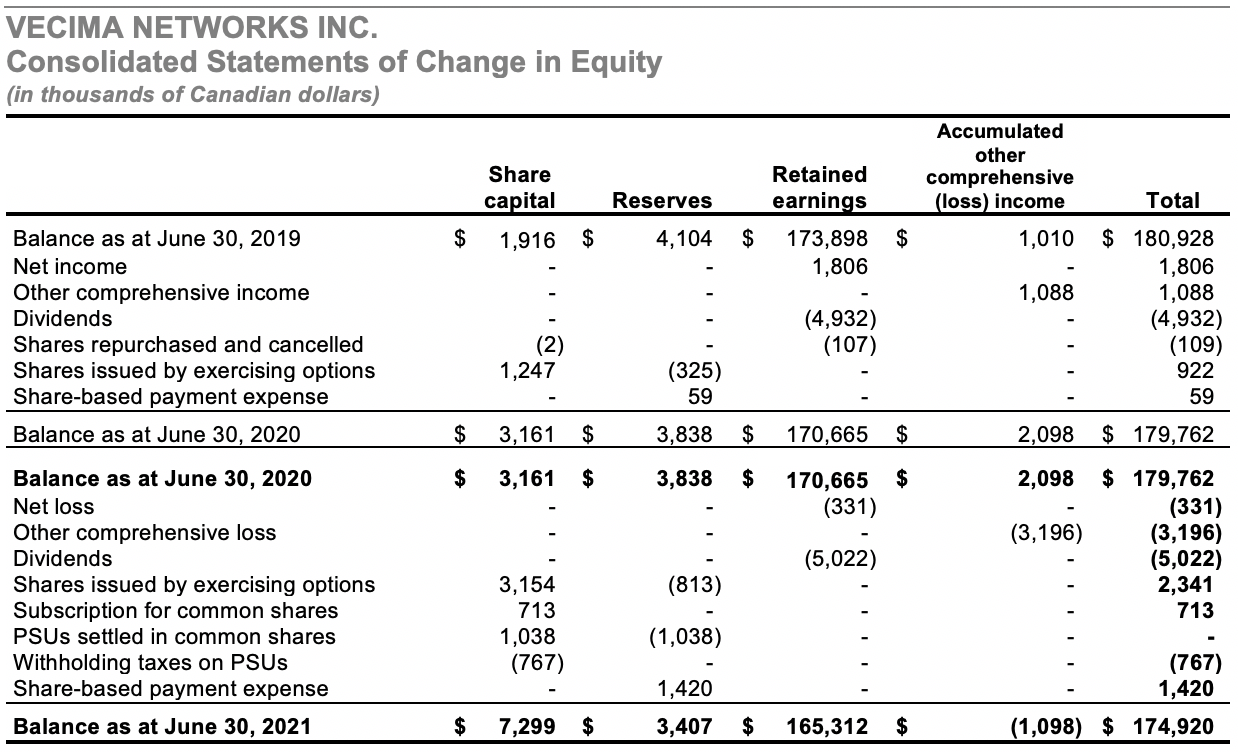

“We ended the year in a very strong financial position with $28.9 million in cash, working capital of $44.8 million, and virtually no debt, even after investing in organic and acquisitions-based growth and continuing to reward investors with dividends of $0.22 per share in fiscal 2021,” said Mr. Kumar.

BUSINESS HIGHLIGHTS

Video and Broadband Solutions (VBS)

Generated strong segment sales with annual VBS revenue increasing 110% to $75.3 million and Q4 VBS sales growing 124% to $23.5 million year-over-year

Entra Family

- Deployments of next-generation Entra products accelerated to $42.6 million in fiscal 2021 and $16.6 million in the fourth quarter, each up seven times from the same periods in fiscal 2020

- Successfully acquired, integrated, and operated the Nokia cable access portfolio, expanding Vecima’s next-generation product offering with market-leading DAA and 10Gig FTTH solutions. The new portfolio significantly exceeded expectations, contributing strong sales of $19.7 million in fiscal 2021 and $9.2 million in the fourth quarter

- Increased total customer engagements for Entra to 71 MSOs worldwide, as compared to 25 at the beginning of the year. Thirty-eight of these customers, including multiple Tier 1 operators, have ordered Entra products (vs three at the beginning of fiscal 2021), setting the stage for multi-year product, support and capacity increases with these customers

- Carried out multiple Tier 1 customer deployments of Entra Remote PHY nodes, Remote MAC-PHY nodes, and 10G EPON FTTH solutions, including delivery of over 4,900 cable and fiber access nodes combined, covering over 8,900 next-generation service groups and passing 12.5 million homes

- Delivered multiple new DAA product and software releases during the year, including the industry’s first fully segmentable, double-density Remote PHY node

- Significantly enhanced Vecima’s industry-leading DAA cable access nodes (EntraPHY and EntraMAC) with numerous leading features including:

- still higher download and upload capacity, over the multigigabit speeds already offered, driving significant cost savings by leveraging preexisting and widely deployed coaxial cable access networks;

- localized regional variants matching unique customer needs in multiple geographies;

- increased interoperability with network ecosystem technologies (an area that Vecima has always led); and

- redundancy additions that further augment the mission-critical durability of our Entra DAA nodes which are being leveraged globally by customers for core broadband internet service

- Multiple in-demand features were added to Vecima’s EntraControl platforms that provide key cloud-native network configuration and management orchestration, including mass-scalability enhancements and statistics that help operators manage large access networks on a ‘millions of homes’ scale

- Widened lead of EntraOptical fiber to the home DAA platforms with added regional product variants, industry-leading in-home FTTH modem ecosystem support and interoperability, and numerous other customer-specific features

Commercial Video Family

- Increased full-year TerraceQAM sales by 34% to $17.1 million and Q4 sales by 21% to $4.4 million as the lead Tier 1 MSO continued to widen its extensive hospitality services platform built on the TerraceQAM

- Terrace family sales provided $14.3 million of contribution in Fiscal 2021 as Tier 1 customers neared full coverage, leading to the anticipated migration to next-generation Terrace IQ platforms

- Delivered initial orders of next-generation TerraceIQ to a North American Tier 1 customer, a deployment win tied to the unique IPTV input, transcoding and digital rights management capabilities of TerraceIQ, driving the future of commercial video services

Content Delivery and Storage (CDS)

- Achieved annual CDS sales of $43.4 and Q4 sales of $10.4 million, despite COVID-19 related delays in project rollouts and the negative impact of global supply chain constraints

- Grew full-year CDS services revenues by 4% year-over-year

- Added five new customers for Vecima’s MediaScaleX IPTV solutions in fiscal 2021

- Divested ContentAgent workflow management business during the year, resulting in a pre-tax gain of approximately US $1.6 million

Telematics

- Continued deployments with municipal government customers, with expansions adding 630 new subscribers in fiscal 2021

- Released new software to enable optional vehicle routing for customers, expanding recurring monthly revenue from existing and new customers

- Continued to penetrate the moveable assets market, including entry into the emergency management systems segment where assets such as defibrillators and stretchers are monitored. Added 15 new customers and 439 additional vehicle subscriptions in fiscal 2021, with the total number of moveable assets being monitored growing to over 11,000 units

“As we start off into fiscal 2022, we see an even sharper growth trajectory for our DAA solutions as an increasing number of customers, including several very large Tier 1 MSOs, ramp up scaling deployments. At the same time, a broad range of other operators are transitioning to first field deployments. We expect our strong customer relationships, leading product offering, and growing global reach will translate into increasing share in the large and rapidly growing distributed access market, a market fueled by the insatiable and ever-growing demand for internet bandwidth to homes and businesses worldwide,” added Mr. Kumar.

“In our Content Delivery and Storage segment, demand for our IPTV and open caching solutions remains robust, and we anticipate steady improvement in our ability to integrate and expand our business wins, including the five new customers added in the past year.”

“While we recognize that ongoing global supply chain challenges could temper our growth and margin potential, particularly in the near term, we are extremely confident in our market position and in Vecima’s ability to capture the major opportunities ahead of us,” said Mr. Kumar.

As previously reported, Vecima’s Board of Directors declared a quarterly dividend of $0.055 per share for the period. The dividend will be payable on November 1, 2021 to shareholders of record as at October 8, 2021.

CONFERENCE CALL

A conference call and live audio webcast will be held today, September 23, 2021 at 1 p.m. ET to discuss the Company’s fourth quarter and year-end results. Vecima’s audited annual consolidated financial statements and management’s discussion and analysis for the three months and year ended June 30, 2021, are available under the Company’s profile at www.SEDAR.com and at www.vecima.com/financials/.

To participate in the teleconference, dial 1-800-319-4610 or 1-604-638-9020. The webcast will be available in real-time at http://services.choruscall.ca/links/vecima20210923.html and will be archived on the Vecima website at http://vecima.com/investor-relations/earnings-call-archive/

About Vecima Networks

Vecima Networks Inc. is a global leader focused on developing integrated hardware and scalable software solutions for broadband access, content delivery, and telematics. We enable the world’s leading innovators to advance, connect, entertain, and analyze. We build technologies that transform content delivery and storage, enable high‑capacity broadband network access, and streamline data analytics. For more information, please visit our website at www.vecima.com.

Adjusted EBITDA and Adjusted Earnings (Loss) Per Share

Adjusted EBITDA and Adjusted Earnings (Loss) Per Share do not have a standardized meaning under IFRS and therefore may not be comparable to similar measures provided by other issuers. Accordingly, investors are cautioned that Adjusted EBITDA or Adjusted Earnings (Loss) Per Share should not be construed as an alternative to net income, determined in accordance with IFRS, as an indicator of the Company’s financial performance or as a measure of its liquidity and cash flows. For a reconciliation of Adjusted EBITDA or Adjusted Earnings (Loss) Per Share, investors should refer to Vecima’s Management’s Discussion and Analysis for the fourth quarter of fiscal 2021.

Forward-Looking Statements

This news release contains “forward-looking information” within the meaning of applicable securities laws. Forward-looking information is generally identifiable by use of the words “believes”, “may”, “plans”, “will”, “anticipates”, “intends”, “could”, “estimates”, “expects”, “forecasts”, “projects” and similar expressions, and the negative of such expressions. Forward-looking information in this news release includes the following statements: fiscal 2021 proved to be the breakout year we envisioned, with our leading products capturing the first wave of our industry’s widescale migration to distributed access architecture or DAA; by virtue of multiple years of investment, innovation, and persistence, Vecima has emerged as a global industry leader in the rapidly growing DAA market; we now boast the industry’s single strongest portfolio of high-speed data access network products for cable and fiber, a large and rapidly growing global base of Tier 1, 2, and 3 customers, and financial results that have started to reflect our momentum; this is only the beginning; the COVID-19 pandemic has created challenges across our industry and many others; restrictions at some of our customers’ operations slowed their ability to integrate and expand the record new business wins of the prior year, constraining this segment’s growth in fiscal 2021; global supply chain tightness also delayed some product lead times and weighed on our fiscal 2021 gross profit margin; we have continued to focus on managing these industry challenges strategically, including leveraging our very strong balance sheet and excellent supplier relationships to increase inventory levels; the new portfolio significantly exceeded expectations; increased total customer engagements for Entra to 71 MSOs worldwide, as compared to 25 at the beginning of the year; thirty-eight of these customers, including multiple Tier 1 operators, have ordered Entra products (vs three at the beginning of fiscal 2021), setting the stage for multi-year product, support and capacity increases with these customers; durability of our Entra DAA nodes which are being leveraged globally by customers for core broadband internet service; Tier 1 customers neared full coverage leading to the anticipated migration to next generation Terrace IQ platforms; delivered initial orders of next-generation TerraceIQ to a North American Tier 1 customer, a deployment win tied to the unique IPTV input, transcoding and digital rights management capabilities of TerraceIQ, driving the future of commercial video services; continued to penetrate the moveable assets market, including entry into the emergency management systems segment where assets such as defibrillators and stretchers are monitored; as we start off into fiscal 2022, we see an even sharper growth trajectory for our DAA solutions as an increasing number of customers, including several very large Tier 1 MSOs, ramp up scaling deployments; we expect our strong customer relationships, leading product offering, and growing global reach will translate into increasing share in the large and rapidly growing distributed access market, a market fueled by the insatiable and ever-growing demand for internet bandwidth to homes and businesses worldwide; demand for our IPTV and open caching solutions remains robust and we anticipate steady improvement in our ability to integrate and expand our business wins; while we recognize that ongoing global supply chain challenges could temper our growth and margin potential, particularly in the near term, we are extremely confident in our market position and in Vecima’s ability to capture the major opportunities ahead of us.

A more complete discussion of the risks and uncertainties facing Vecima is disclosed under the heading “Risk Factors” in the Company’s Annual Information Form dated September 23, 2021, as well as the Company’s continuous disclosure filings with Canadian securities regulatory authorities available at www.sedar.com. All forward-looking information herein is qualified in its entirety by this cautionary statement, and Vecima disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events or developments, except as required by law.

Vecima Networks

Investor Relations – 250-881-1982

Back to all Press Releases

Contact Investor Relations

Vecima Networks Inc.

201-771 Vanalman Avenue, Victoria, BC V8Z-3B8. Canada

Phone: (250) 881-1982 Fax: (250) 881-1974

Email: invest@vecima.com