Vecima Reports Q4 and Fiscal 2020 Results

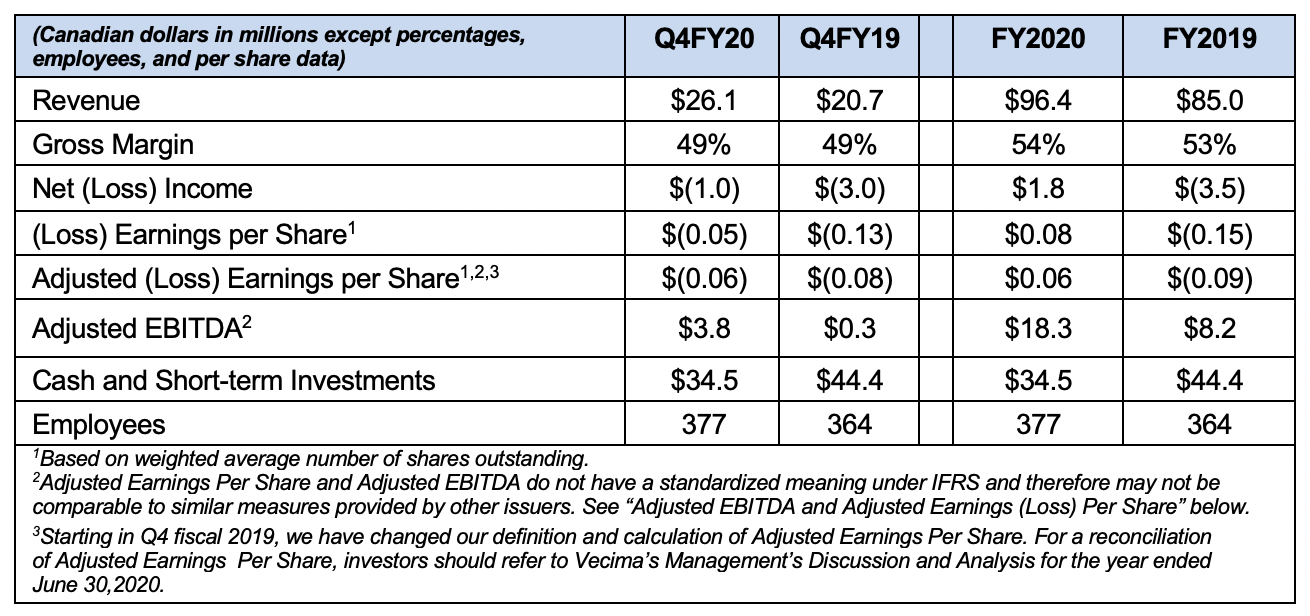

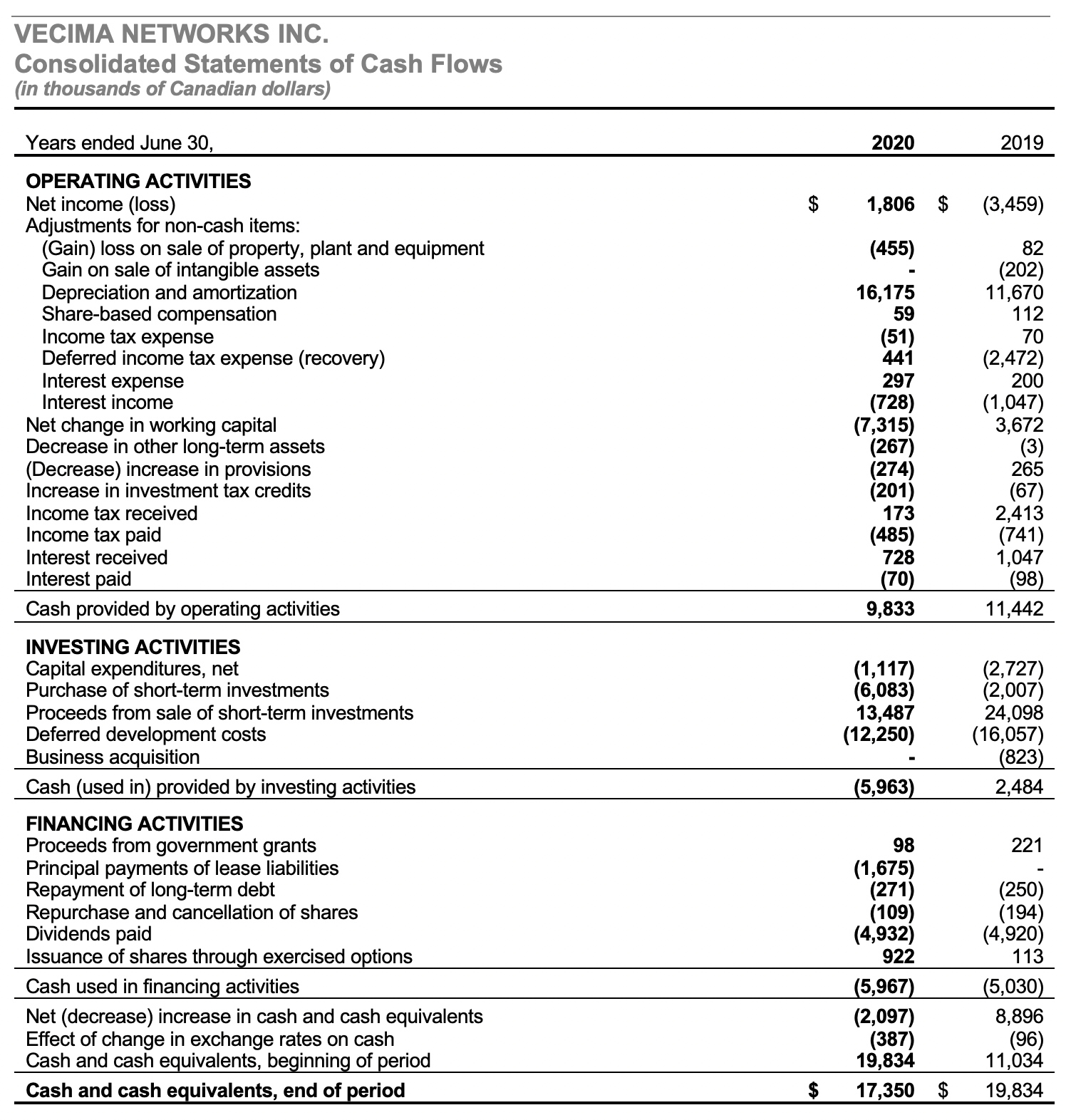

- FY 2020 Revenue – $96.4M, Gross Margin 54%, Cash Balance: $34.5M

- Grew full-year Adjusted EBITDA to $18.3M, an increase of 123%

- Achieved record FY2020 Content Delivery and Storage results and growth, with segment revenue growing 32% and gross profit increasing 38% year-over-year

- Captured next generation Entra family sales of $5.3M in Fiscal 2020, including $2.1M in Q4 2020 representing only the very start of the major DAA market ahead for the company

- Acquired Nokia’s cable access portfolio of DAA and EPON/DPoE solutions subsequent to year-end, creating the industry’s most comprehensive next generation access ecosystem, significantly accelerating Vecima’s 10G technology timeline and catapulting Vecima to the leading DAA vendor position

VICTORIA, BC – (September 24, 2020) – Vecima Networks Inc. (TSX: VCM) today reported financial results for the three months and fiscal year ended June 30, 2020.

FINANCIAL HIGHLIGHTS

“Fiscal 2020 was an extraordinary year for Vecima as our financial performance soared, we built significant momentum for our next generation Distributed Access Architecture (DAA) and IPTV solutions, and we cemented our industry leadership in the DAA space with a strategic technology acquisition that closed shortly after year-end,” said Sumit Kumar, Vecima Networks’ President and CEO. “Significantly, we made these strides while navigating the challenges of the COVID-19 pandemic, an achievement that speaks volumes about the commitment and talents of the Vecima team, and underscores our role in providing essential telecommunications infrastructure that the world increasingly depends upon.”

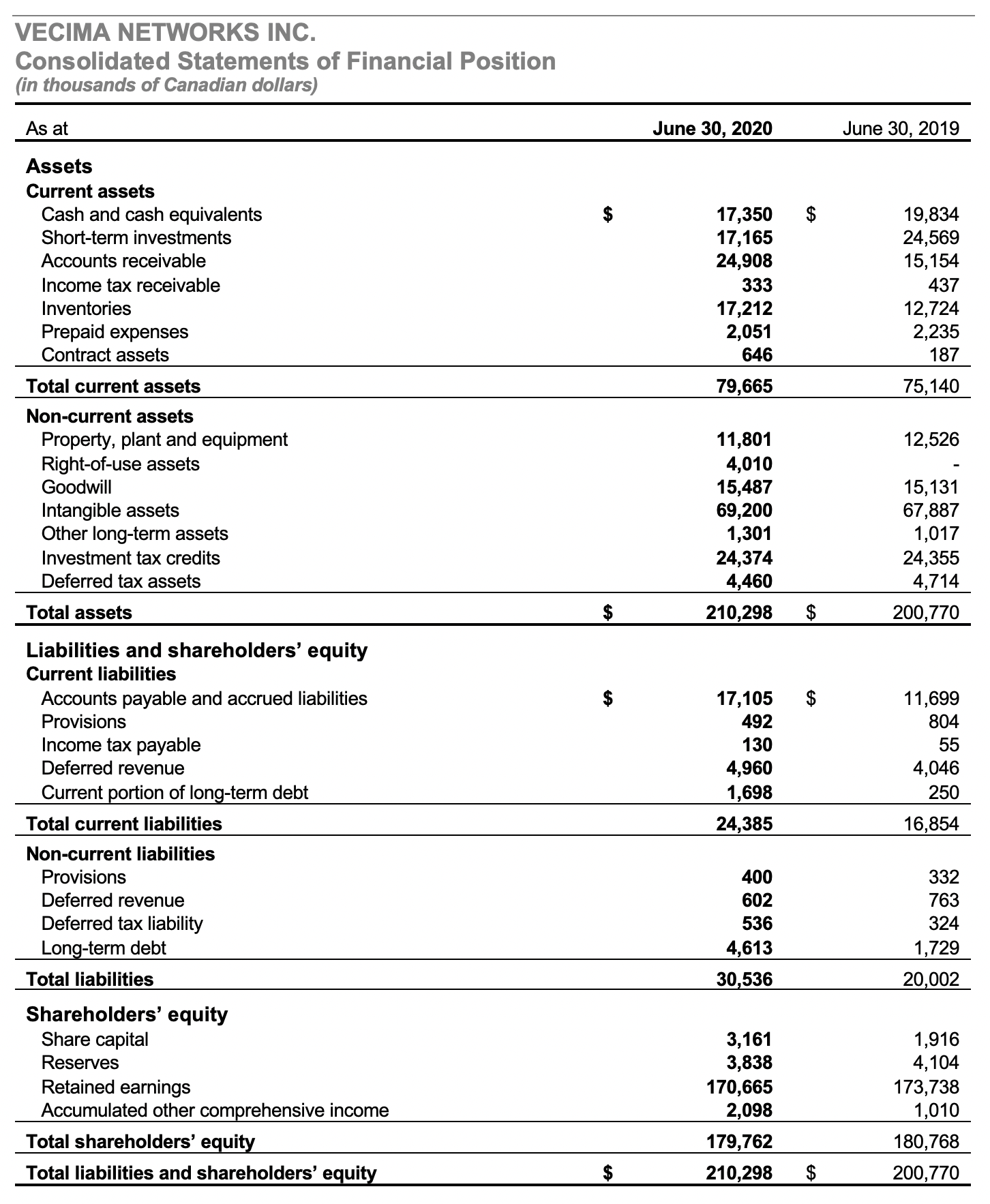

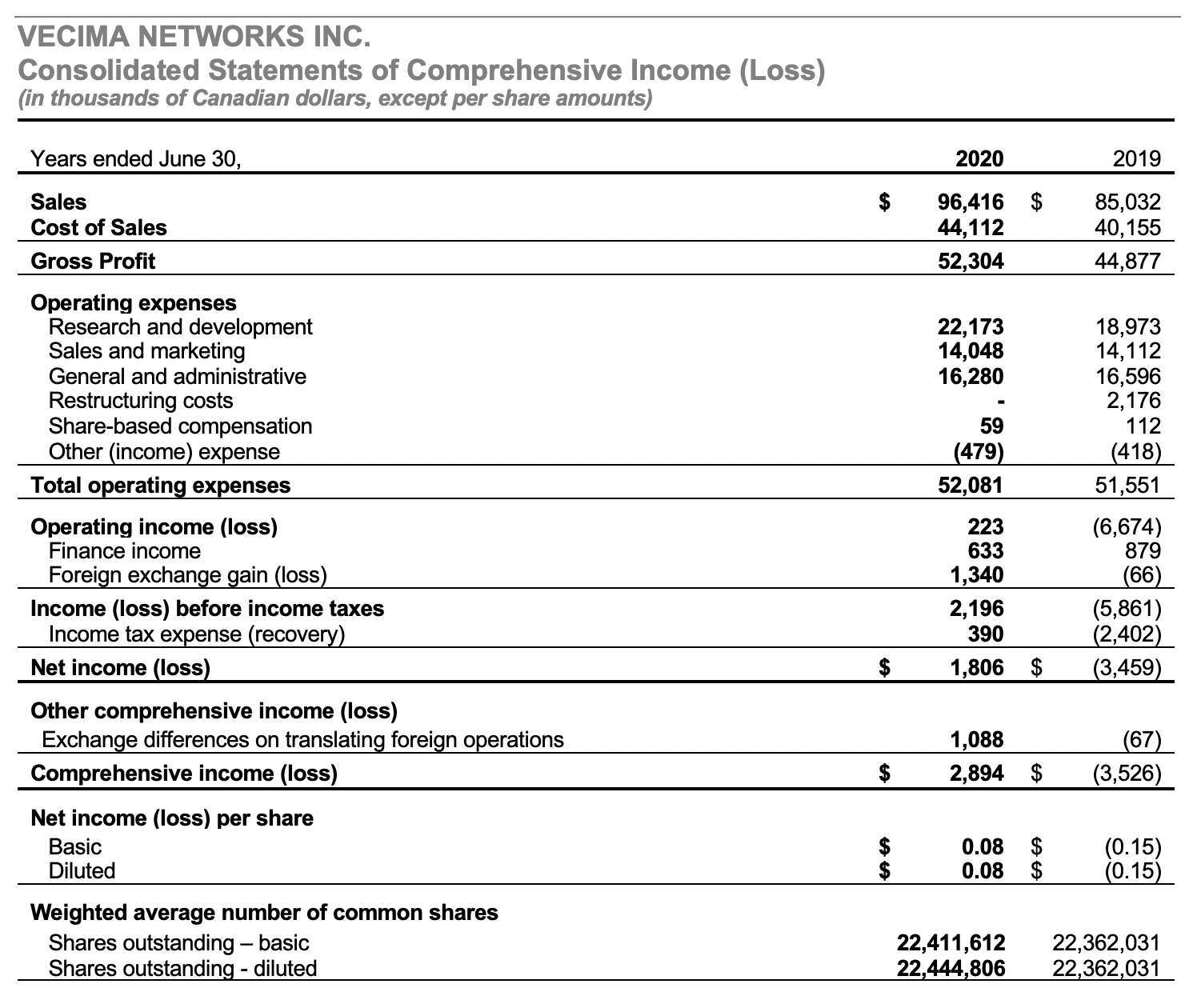

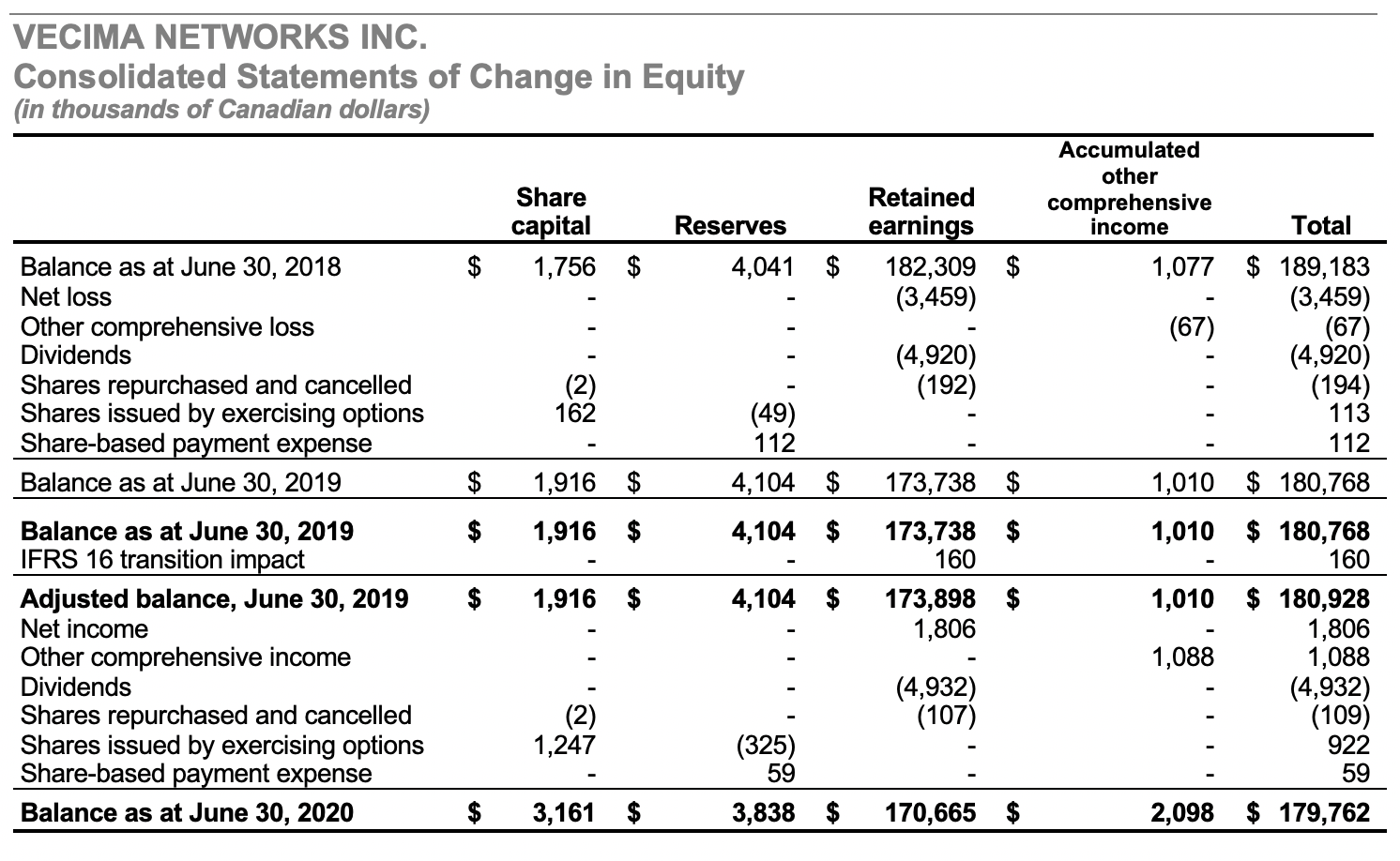

“Financially, fiscal 2020 revenues of $96.4 million and fourth quarter revenues of $26.1 million were our best in four years, led by outstanding growth performance from our Content Delivery and Storage (CDS) segment. Full-year CDS segment revenues increased 32% year-over-year to a record $55.2 million, driven by an expanding global base of service providers that are using our MediaScaleX solutions to power their evolution to IPTV. Our CDS segment captured 13 new IPTV customers during fiscal 2020, including three in the fourth quarter, and by year’s end, we were actively selling to over 100 customers worldwide. Importantly, this was highly profitable growth, with CDS segment gross profit climbing 38% year-over-year to a record $31.7 million. This, in turn, helped to drive FY2020 consolidated gross profit of $52.3 million and Adjusted EBITDA of $18.3 million, a year-over-year increase of 17% and 123% respectively.”

“In our Video and Broadband Solutions (VBS) segment, we accomplished the critical objective of bringing our next generation Entra family of DAA products to market during the year. I am elated to report we achieved material revenue of $5.3 million from our Entra portfolio, secured our first major Tier 1 DAA customer contract, and in the fourth quarter, completed initial product deployments of our industry-leading, multi-core interoperable Entra Remote PHY nodes. Subsequent to year-end, we further advanced our position in the DAA market with our acquisition of Nokia’s cable access business, including market-ready Remote MAC-PHY, access controller, and 10Gig EPON products. By consolidating the industry’s leading DAA products and IP, Vecima has emerged as the prime holder of DAA technology in the industry.”

BUSINESS HIGHLIGHTS

Video and Broadband Solutions

- Entra Family

- Deployments of next generation Entra DAA products tied to the earliest stages of the market contributed full-year sales of $5.3 million and Q4 sales of $2.1 million, up significantly from $1.2 million and $0.6 million, respectively, in the same periods of fiscal 2019

- Vecima’s lead Tier 1 customer began first in-field service group deployments of the Company’s industry-leading, multi-core interoperable Entra Remote PHY node in Q4. Vecima has received orders covering multiple geographies and markets within the Tier 1 customer’s footprint

- Multiple products within Vecima’s broad Entra DAA ecosystem were purchased by a wide group of MSOs as the industry kicked off on the network evolution to distributed access architecture throughout the year

- Through the course of FY20 Vecima continued to build out a powerful and unparalleled portfolio of Entra platforms that are making DAA a reality as the industry sets off on the associated major network infrastructure upgrade. Highlights included:

- the Entra EN8124 node, doubling downstream and upstream capacity in a single Remote PHY node;

- the Entra Interactive Video Controller, providing essential two-way connectivity to interactive set-top boxes in a DAA architecture;

- major releases of the Entra RPM, which has proven a critical configuration service assurance and monitoring platform; and

- the paired Entra LQA and VQM products that maintain legacy video services in a DAA environment that are material to MSO revenues.

- Subsequent to year-end on August 7, Vecima significantly expanded and accelerated its Entra offering by closing an acquisition of Nokia’s cable access portfolio of Access Controller, Remote MAC-PHY and 10G EPON/DPoE products. Vecima now offers the broadest full complement of access network solutions in the industry, spanning the varied needs of cable operators globally

- Combined with the expansion the Company drove in Fiscal 20, the market acceleration and broader scope achieved with the Nokia cable access portfolio acquisition has increased Vecima’s global engagements for Entra across a wide spectrum of operators encompassing multiple tiers, geographies and access network profiles. Vecima now has engagements for access network technologies with 41 operators, including 27 operators that are either in lab trial, field trial, or live deployment phases across the globe

- Commercial Video Family

- Increased full-year TerraceQAM sales by 93% and Q4 sales by 98% year-over-year as the lead Tier 1 MSO widened its extensive hospitality services platform, while preparing for migration to the next generation TerraceIQ system

- Terrace family sales of $16.3 million in Fiscal 20 continued to provide ongoing contribution as Tier 1 customers neared full coverage leading up to the migration to the TerraceIQ next generation platforms

- Continued to progress development of the TerraceIQ platform, supporting the intent of customers to upgrade their widely deployed ecosystems of the Terrace and TerraceQAM products as networks move to IPTV

Content Delivery and Storage

- Generated record annual segment sales with revenue increasing 32% to $55.2 million year-over-year. Q4 sales grew 14% to $14.3 million

- Secured 13 new customers for Vecima’s MediaScaleX IPTV products, including three new customers in Q4 and bringing to 34 the number of operators now using Vecima products to deliver IPTV. Achieved an additional two new customer wins subsequent to year-end

- Further increased deployments of IPTV solutions with cable operators, telcos and broadcasters around the world, selling to over 100 customers in fiscal 2020 representing a combined operator footprint of over 132 million subscribers

- Established all-time record for services revenue, reflecting the large number of new deployments and the high-value services offered by the CDS team

- Signed agreement to supply CDN to a Tier 1 MSO operating across Latin America and the Caribbean in Q1 for its IPTV network

- Robust sales uptake in Q2 of a major software release upgrade by a world top‑five MSO where MediaScaleX is deployed to provide on‑demand video across over 75% of the operator’s footprint

- Revenue from outside North America grew to a record high of 37%, highlighting our geographic diversification and emerging strength in Latin America

- Responded to major increases in capacity utilization across all networks due to increased demand related to COVID-19 by delivering higher capacity across a number of customer deployments

- Set the stage for FY2021 by securing largest order in CDS segment’s history. Under the agreement, Vecima will provide a full refresh of a Tier 1 APAC customer’s Origin, Storage and CDN platform over the course of several quarters

Telematics

- Continued rollout of previously announced City of Saskatoon fleet management solution, as well as expansions with other municipal government customers

- Continued penetration of moveable assets market, adding 21 new customers in FY2020, including four in Q4

“As we move into FY2021, Vecima is now positioned to achieve strong sales growth for our Entra DAA products, particularly in the latter half of the year as we transition to scale deployment with our lead customers and to initial field deployment with a broader set of cable customers, while concurrently leveraging our newly acquired Remote MAC-PHY and EPON products. In our CDS segment, we anticipate measured sales growth in FY2021 as we consolidate the record-setting business wins of fiscal 2020, including two additional customer wins since year-end, and continue to build the business.”

“Overall, we anticipate a very strong fiscal 2021 for Vecima as our multi-year investment, development, and strategic acquisition strategy continues to bear fruit,” concluded Mr. Kumar.

As previously reported, Vecima’s Board of Directors declared a quarterly dividend of $0.055 per share for the period. The dividend will be payable on November 2, 2020 to shareholders of record as at October 9, 2020.

CONFERENCE CALL

A conference call and live audio webcast will be held today, September 24, 2020 at 1 p.m. ET to discuss the Company’s fourth quarter and full-year results. Vecima’s consolidated financial statements and management’s discussion and analysis for the year ended June 30, 2020 are available under the Company’s profile at www.SEDAR.com, and at www.vecima.com/financial-reports/

To participate in the teleconference, dial 1-800-319-4610 or 1-604-638-9020. The webcast will be available in real time at http://services.choruscall.ca/links/vecima20200924.html and will be archived on the Vecima website at http://vecima.com/investor-relations/earnings-call-archive/

About Vecima Networks

Vecima Networks Inc. is a global leader focused on developing integrated hardware and scalable software solutions for broadband access, content delivery, and telematics. We enable the world’s leading innovators to advance, connect, entertain, and analyze. We build technologies that transform content delivery and storage, enable high‑capacity broadband network access, and streamline data analytics. For more information, please visit our website at www.vecima.com.

Adjusted EBITDA and Adjusted (Loss) Earnings Per Share

Adjusted EBITDA and Adjusted (Loss) Earnings Per Share do not have a standardized meaning under IFRS and therefore may not be comparable to similar measures provided by other issuers. Accordingly, investors are cautioned that Adjusted EBITDA or Adjusted (Loss) Earnings Per Share should not be construed as an alternative to net income, determined in accordance with IFRS, as an indicator of the Company’s financial performance or as a measure of its liquidity and cash flows. For a reconciliation of Adjusted EBITDA or Adjusted (Loss) Earnings Per Share, investors should refer to Vecima’s Management’s Discussion and Analysis for the year ended June 30, 2020.

Forward-Looking Statements

This news release contains “forward-looking information” within the meaning of applicable securities laws. Forward-looking information is generally identifiable by use of the words “believes”, “may”, “plans”, “will”, “anticipates”, “intends”, “could”, “estimates”, “expects”, “forecasts”, “projects” and similar expressions, and the negative of such expressions. Forward-looking information in this news release includes the following statements: we built significant momentum for our next generation Distributed Access Architecture (DAA) and IPTV solutions; we cemented our industry leadership in the DAA space with a strategic technology acquisition; we further advanced our position in the DAA market; by consolidating the industry’s leading DAA products and IP, Vecima has emerged as the prime holder of DAA technology in the industry; Vecima continued to build out a powerful and unparalleled portfolio of Entra platforms that are making DAA a reality; Vecima significantly expanded and accelerated its Entra offering; continued to progress development of the TerraceIQ platform, supporting the intent of customers to upgrade their widely deployed ecosystems of the Terrace and TerraceQAM products as networks move to IPTV; as we move into FY2021, Vecima is now positioned to achieve strong sales growth for our Entra DAA products, particularly in the latter half of the year, as we transition to scale deployment with our lead customers and to initial field deployment with a broader set of cable customers, while concurrently leveraging our newly acquired Remote MAC-PHY and EPON products; in our CDS segment, we anticipate measured sales growth in FY2021 as we consolidate the record-setting business wins of fiscal 2020, including two additional customer wins since year-end, and continue to build the business; overall, we anticipate a very strong fiscal 2021 for Vecima as our multi-year investment, development, and strategic acquisition strategy continues to bear fruit.

A more complete discussion of the risks and uncertainties facing Vecima is disclosed under the heading “Risk Factors” in the Company’s Annual Information Form dated September 24, 2020, as well as the Company’s continuous disclosure filings with Canadian securities regulatory authorities available at www.sedar.com. All forward-looking information herein is qualified in its entirety by this cautionary statement, and Vecima disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events or developments, except as required by law.

Vecima Networks

Investor Relations – 250-881-1982

invest@vecima.com

Back to all Press Releases

Contact Investor Relations

Vecima Networks Inc.

201-771 Vanalman Avenue, Victoria, BC V8Z-3B8. Canada

Phone: (250) 881-1982 Fax: (250) 881-1974

Email: invest@vecima.com