Vecima Reports Q3 Fiscal 2021 Results

-

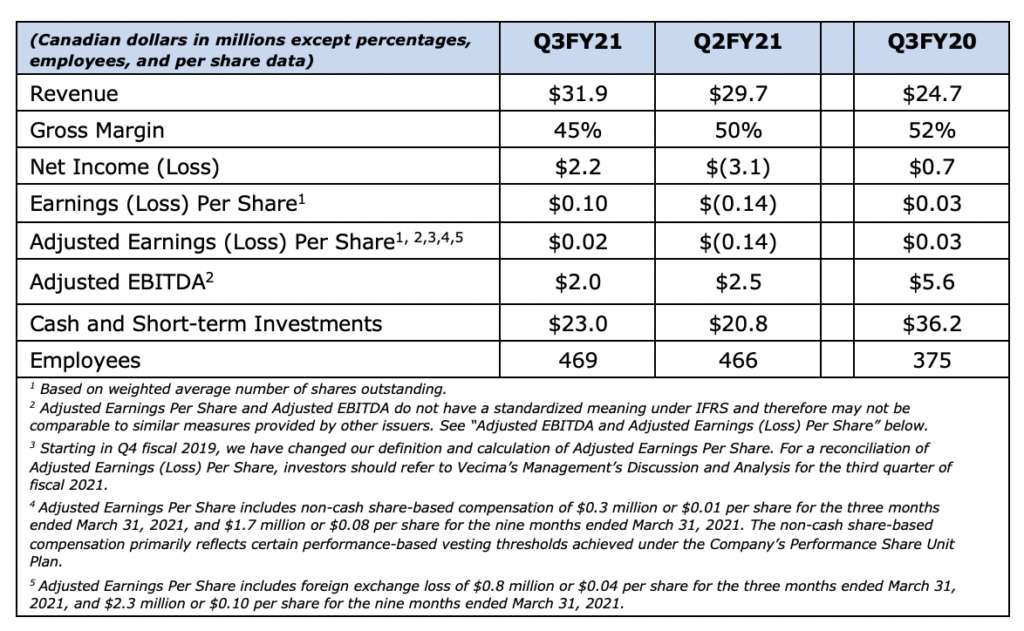

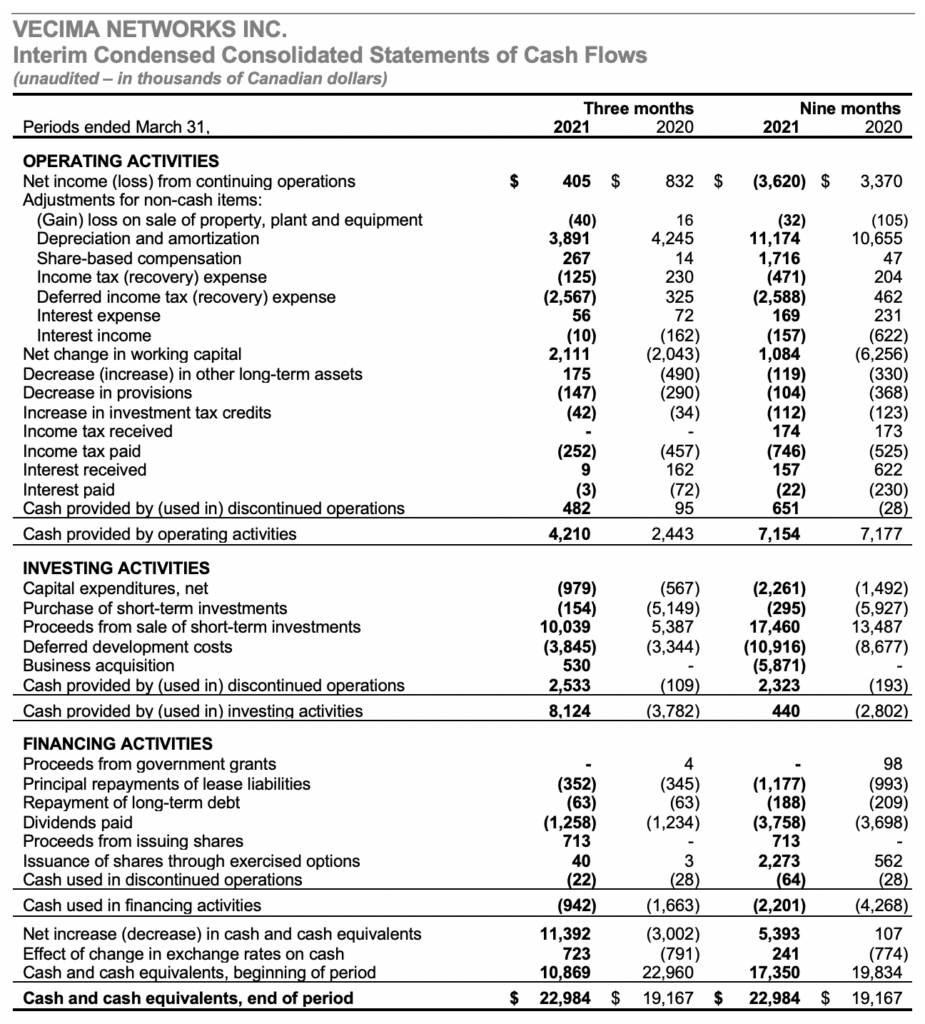

Revenue – $31.9M, Cash Balance – $23.0M

-

Gross profit grew to $14.3M, a year-over-year increase of 12%

-

Entra DAA sales continued to accelerate, climbing six times to $12.7M year-over-year, and growing 58% quarter-over-quarter

-

Customer engagements and order flow for Entra family significantly ramped once more

-

TerraceQAM sales increased 49% to $5.2M year-over-year

VICTORIA, BC – (May 13, 2021) – Vecima Networks Inc. (TSX: VCM) today reported financial results for the three months ended March 31, 2021.

FINANCIAL HIGHLIGHTS

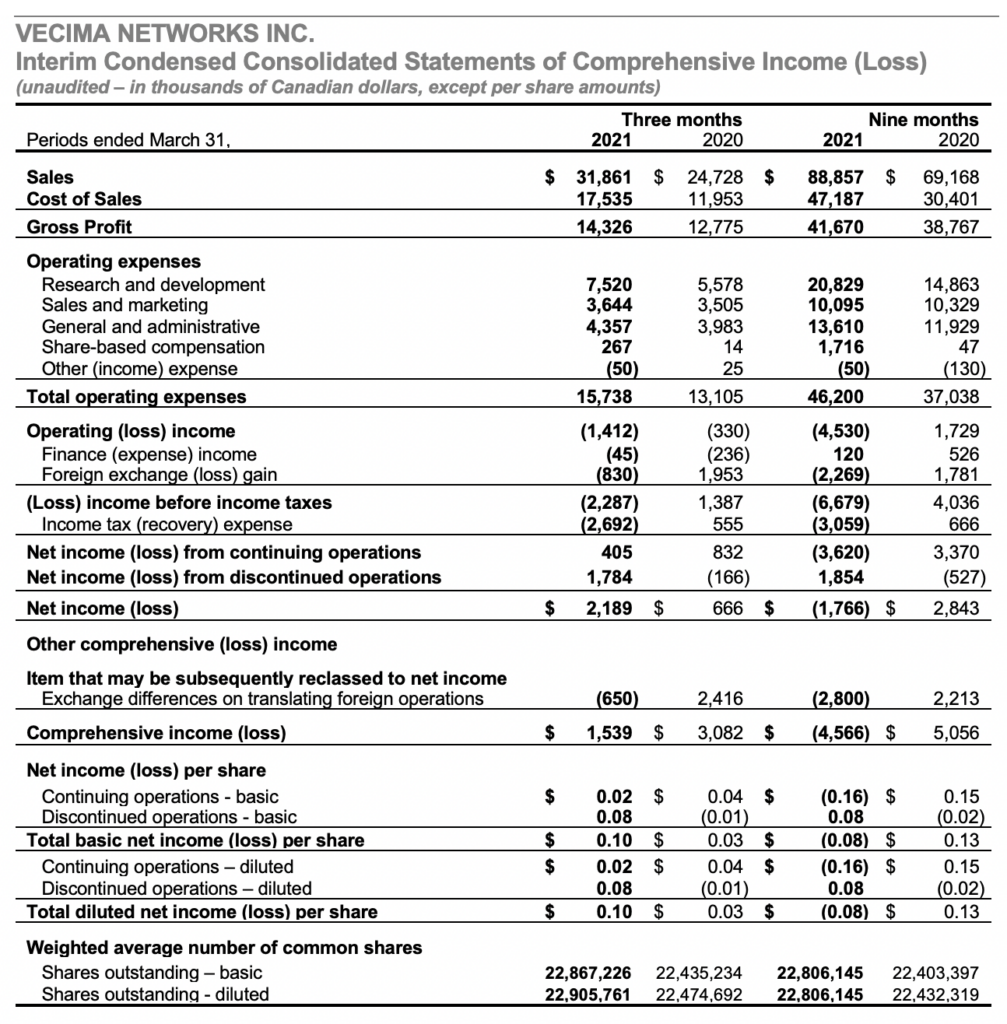

“Vecima grew total sales by 29% year-over-year to $31.9 million in the third quarter as customer deployments accelerated across our broad portfolio of next-generation Entra Distributed Access Architecture (DAA) products,” said Sumit Kumar, Vecima’s President and Chief Executive Officer. “Additionally, we generated gross profit of $14.3 million and adjusted EBITDA of $2.0 million, which we achieved despite pronounced lumpiness in third quarter Content Delivery and Storage sales, continued foreign exchange headwinds related to the strengthening Canadian dollar, and an atypical product mix in the period that in combination temporarily reduced gross margin.”

“In our Video and Broadband Solutions (VBS) segment, sales were up an impressive 128% year-over-year to $21.8 million, led by very strong demand for our leading Entra Remote-PHY, Remote MAC-PHY and 10G EPON DAA solutions. Entra sales of $12.7 million reflected multiple additional Tier 1 and other customer deployments during the quarter, including expanded engagements with several of our customers. The VBS segment also benefited from an excellent quarter for our TerraceQAM commercial video solutions, with sales up 49% year-over-year. The continued strong deployment of TerraceQAM provides benefits both now and for the future, with the entire population of TerraceQAM platforms upgradable to our new TerraceIQ solution when operators are ready.”

“In our Content Delivery and Storage (CDS) segment, revenue of $8.8M reflected the type of quarterly revenue fluctuation that can affect this segment and which relates to the size and timing of project-oriented orders. Our CDS business also faced impacts related to the COVID-19 pandemic, which has slowed our and our customers’ ability to conduct onsite systems integration, bring-up and expansion in some regions. Based on our visibility today, CDS sales are expected to normalize in the quarters ahead as we continue to consolidate the record new customer wins of fiscal 2020, while safely navigating COVID-19 operating restrictions.”

BUSINESS HIGHLIGHTS

Video and Broadband Solutions (VBS)

- The VBS segment delivered exciting revenue growth of 128% year-over-year and 32% quarter-over-quarter, generating $21.8 million in sales as customers continued to transition to next generation networks using Vecima’s platforms

DAA (Entra Family)

- Deployments of next generation Entra DAA products continued to accelerate rapidly, climbing six times to $12.7 million in Q3 fiscal 2021 from $1.8 million in Q3 fiscal 2020, and up 58% sequentially from $8.0 million in Q2 fiscal 2021. Entra results for the quarter included $6.0 million of sales from the cable access portfolio acquired from Nokia in Q1FY2021, a 76% increase from $3.4 million in Q2 fiscal 2021

- Carried out multiple additional Tier 1 customer deployments for Entra Remote-PHY, Remote MAC-PHY nodes and 10G EPON solutions during the quarter, and expanded engagements with a number of existing customers

- Thirty-three customers on six continents have now ordered Entra solutions, a sizeable jump from 24 in the previous quarter, and total customer engagements for Entra have grown to include 61 MSOs worldwide, including several Tier 1 operators. Fifty of these operators are in lab trial, field trial or live deployment phases

- Initiated deployments of Vecima’s Entra EN8124, the industry’s first fully segmentable, double-density Remote PHY node, with lead Tier 1 MSO customer

- Received significant order for EN2112 compact Remote PHY node from a CALA-based Tier 1 MSO and initiated deliveries in the third quarter

- Released numerous software enhancements to the Remote PHY family of products, including customer-desired features such as additional video injection, interoperability, and spectrum capture modes

- Delivered major new software release for Entra Remote MAC-PHY and 10G EPON FTTH platforms, which provides significant operational and performance enhancements, and a cloud native deployment roadmap with support for virtual machine environments

- Expanded 10G EPON fiber-to-the-home ecosystem by incorporating interoperability with multiple additional third-party vendors of Optical Network Units (ONUs), which serve as in-home modems in a FTTH deployment

- Acquired and progressed development of unique access node housing technology from ATX Networks, continuing Vecima’s DAA industry stewardship with a forward-looking, standardized, and modular DAA node platform for future generations of DAA

- Furthered development of a new, next generation of Cable Access modules and nodes, which are expected to further cement Vecima’s unique leadership position in DAA technology for years to come

Commercial Video (Terrace Family)

- Generated a solid $3.5 million of Terrace family revenue in the third quarter, following particularly strong second quarter sales of $5.2 million

- Significantly increased TerraceQAM sales to $5.2 million, up 49% from $3.5 million in the same period last year, and up 61% from $3.2 million in Q2 2021 with the lead Tier 1 customer continuing its scale hospitality program with the platform

- Following recent Tier 1 customer win for Vecima’s next generation TerraceIQ commercial video gateway solution, further expanded this platform’s software feature set in preparation for broader customer adoption, including features that enhance the platform’s leading capabilities for management, monitoring, network resiliency and deployment velocity in the hospitality vertical

Content Delivery and Storage (CDS)

- CDS sales were $8.8 million, with segment service revenues growing by 6% year-over-year

- Sold ContentAgent workflow management business on March 31, 2021 to Telestream for US$2.1 million, resulting in a pre-tax gain of approximately US$1.6 million

- Expanded subscriber uptake at existing IP video customers, demonstrating the inherent scalability of Vecima’s content delivery technology and products

- Developed additional audio/video profile capability for the MediaScaleX//Origin platform, offering a market-unique ability to utilize unified content libraries distributed to both OTT media player devices and legacy set-top boxes

- Expanded broad partner integrations to add another leading middleware provider integration with MediaScaleX//Origin and Storage products for cloud DVR and digital rights management

- Added enhanced Dynamic Ad Insertion features to the MediaScaleX portfolio software

Telematics

- Continued deployments with municipal government customers, with expansion adding 330 new subscribers

- Further penetration in the moveable assets market, adding five new customers representing an additional 1,000 moveable asset tags. Total number of moveable assets being monitored has now increased to over 10,000 units

“Operators worldwide are prioritizing broadband access network investments as they seek to expand bandwidth across their networks, creating rapidly increasing demand for our industry-leading portfolio of DAA products. We expect to see our Entra momentum continue to escalate through the balance of fiscal 2021 and into fiscal 2022,” added Mr. Kumar.

“Demand for IPTV and open caching solutions also remains strong and we expect to carry out integration of the many new CDS design wins from last year while safely managing customer site activity in the midst of the pandemic environment.”

“Overall, we anticipate a very strong finish to this pivotal fiscal year with VBS sales in their ramp and CDS revenues stabilizing. While we may be subject to further foreign exchange headwinds related to a stronger Canadian dollar, we expect gross margins to increase as our product mix shifts to include a larger proportion of higher-margin products and license sales. Moving beyond year-end, we see realization ahead of the vast potential for our growing portfolios of DAA and IPTV solutions and that will propel us to the exciting future we have been planning for Vecima.”

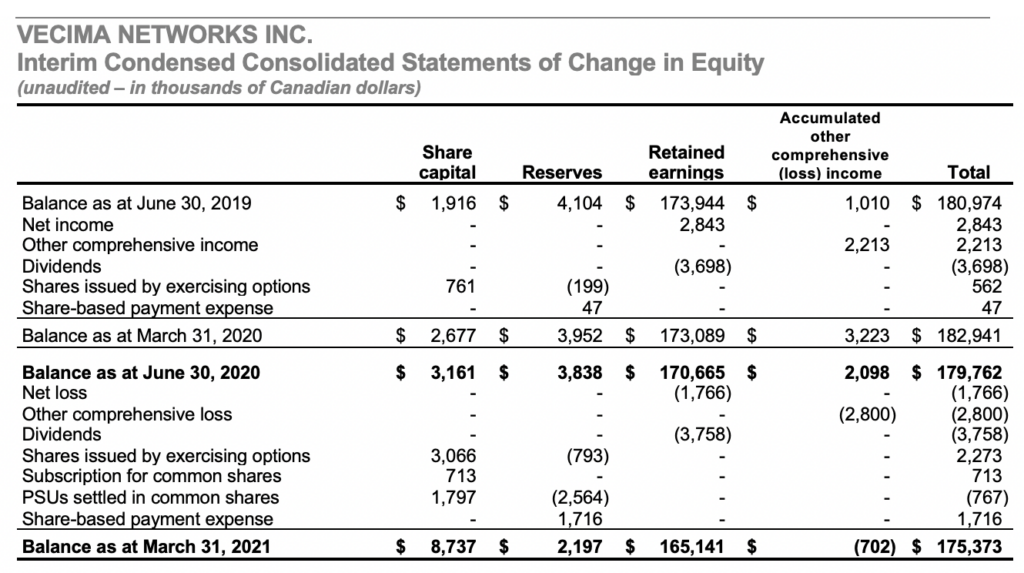

As previously reported, Vecima’s Board of Directors declared a quarterly dividend of $0.055 per share for the period. The dividend will be payable on June 14, 2021 to shareholders of record as at May 21, 2021.

CONFERENCE CALL

A conference call and live audio webcast will be held today, May 13, 2021 at 1 p.m. ET to discuss the Company’s third quarter results. Vecima’s unaudited condensed interim consolidated financial statements and management’s discussion and analysis for the three and nine months ended March 31, 2021 are available under the Company’s profile at www.SEDAR.com, and at www.vecima.com/financials/.

To participate in the teleconference, dial 1-800-319-4610 or 1-604-638-9020. The webcast will be available in real time at http://services.choruscall.ca/links/vecima20210513.html and will be archived on the Vecima website at http://vecima.com/investor-relations/earnings-call-archive/

About Vecima Networks

Vecima Networks Inc. is a global leader focused on developing integrated hardware and scalable software solutions for broadband access, content delivery, and telematics. We enable the world’s leading innovators to advance, connect, entertain, and analyze. We build technologies that transform content delivery and storage, enable high‑capacity broadband network access, and streamline data analytics. For more information, please visit our website at www.vecima.com.

Adjusted EBITDA and Adjusted Earnings / (Loss) Per Share

Adjusted EBITDA and Adjusted Earnings / (Loss) Per Share do not have a standardized meaning under IFRS and therefore may not be comparable to similar measures provided by other issuers. Accordingly, investors are cautioned that Adjusted EBITDA or Adjusted Earnings / (Loss) Per Share should not be construed as an alternative to net income, determined in accordance with IFRS, as an indicator of the Company’s financial performance or as a measure of its liquidity and cash flows. For a reconciliation of Adjusted EBITDA or Adjusted Earnings / (Loss) Per Share, investors should refer to Vecima’s Management’s Discussion and Analysis for the third quarter of fiscal 2021.

Forward-Looking Statements

This news release contains “forward-looking information” within the meaning of applicable securities laws. Forward-looking information is generally identifiable by use of the words “believes”, “may”, “plans”, “will”, “anticipates”, “intends”, “could”, “estimates”, “expects”, “forecasts”, “projects” and similar expressions, and the negative of such expressions. Forward-looking information in this news release includes the following statements: sales were led by very strong demand for our leading Entra Remote-PHY, Remote MAC-PHY and 10G EPON DAA solutions; [our CDS segment] revenue reflected the type of quarterly revenue fluctuation that can affect this segment and which relates to the size and timing of project-oriented orders; our CDS business also faced impacts related to the COVID-19 pandemic, which has slowed our and our customers’ ability to conduct onsite systems integration, bring-up and expansion in some regions; based on our visibility today, CDS sales are expected to normalize in the quarters ahead as we continue to consolidate the record new customer wins of fiscal 2020, while safely navigating COVID-19 operating restrictions; the VBS segment delivered exciting revenue growth as customers continued to transition to next generation networks using Vecima’s platforms; acquired and progressed development of unique access node housing technology, continuing Vecima’s DAA industry stewardship with a forward-looking, standardized, and modular DAA node platform for future generations of DAA; furthered development of a new, next generation of Cable Access modules and nodes, which is expected to further cement Vecima’s unique leadership position in DAA technology for years to come; operators worldwide are prioritizing broadband access network investments as they seek to expand bandwidth across their networks, creating rapidly increasing demand for our industry-leading portfolio of DAA products; we expect to see our Entra momentum continue to escalate through the balance of fiscal 2021 and into fiscal 2022; demand for IPTV and open caching solutions also remains strong and we expect to carry out integration of the many new CDS design wins from last year while safely managing customer site activity in the midst of the pandemic environment; overall, we anticipate a very strong finish to this pivotal fiscal year with VBS sales in their ramp and CDS revenues stabilizing; while we may be subject to further foreign exchange headwinds related to a stronger Canadian dollar, we expect gross margins to return to the target range as our product mix shifts to include a larger proportion of higher-margin products and license sales; moving beyond year-end, we see realization ahead of the vast potential for our growing portfolios of DAA and IPTV solutions and that will propel us to the exciting future we have been planning for Vecima.

A more complete discussion of the risks and uncertainties facing Vecima is disclosed under the heading “Risk Factors” in the Company’s Annual Information Form dated September 24, 2020, as well as the Company’s continuous disclosure filings with Canadian securities regulatory authorities available at www.sedar.com. All forward-looking information herein is qualified in its entirety by this cautionary statement, and Vecima disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events or developments, except as required by law.

Vecima Networks

Investor Relations – 250-881-1982

invest@vecima.com

Back to all Press Releases

Contact Investor Relations

Vecima Networks Inc.

201-771 Vanalman Avenue, Victoria, BC V8Z-3B8. Canada

Phone: (250) 881-1982 Fax: (250) 881-1974

Email: invest@vecima.com