Vecima Reports Q2 Fiscal 2023 Results

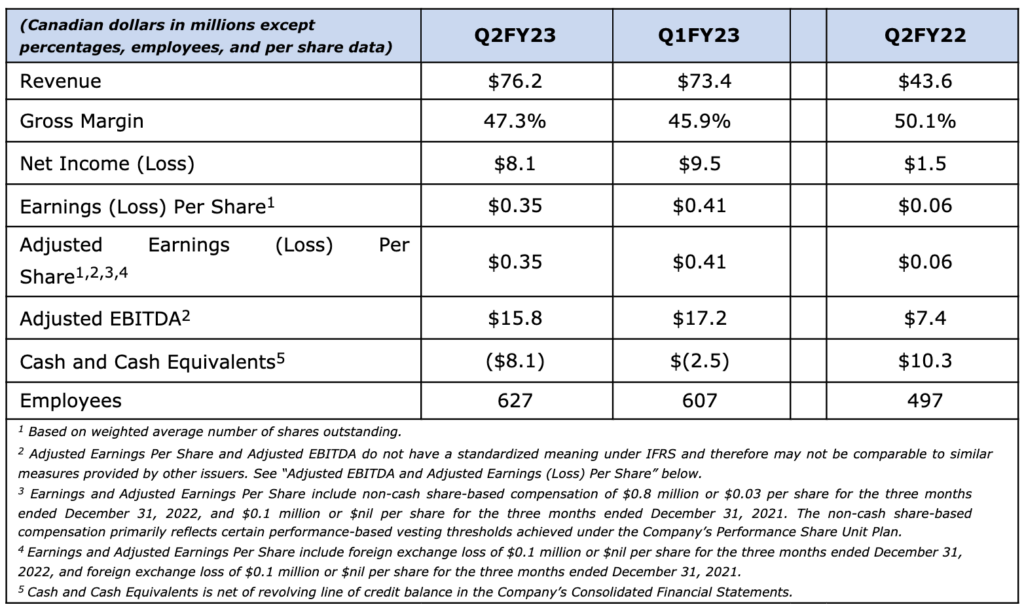

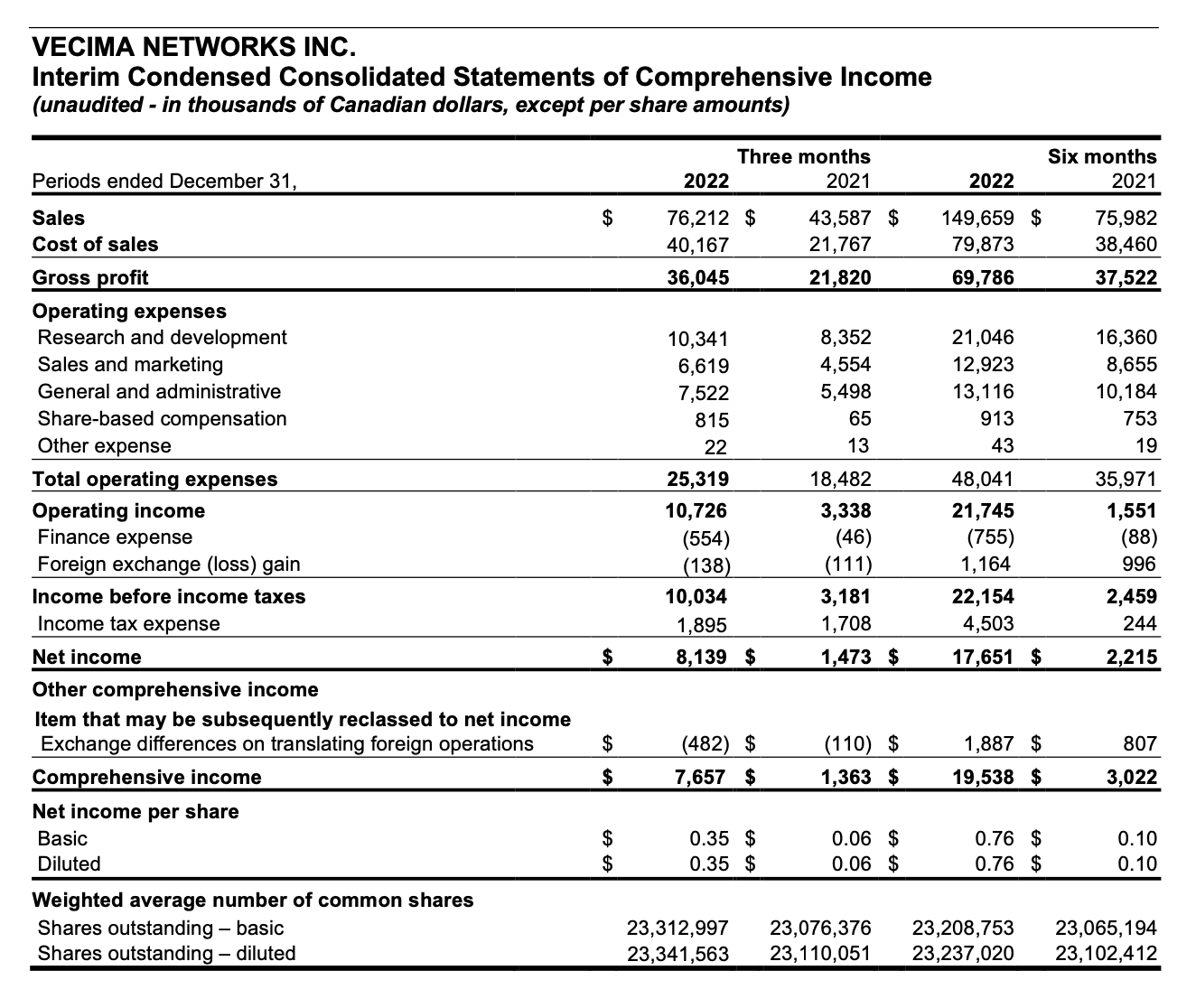

- Revenue of $76.2M (+75% YoY); Gross Profit of $36.0M (+65% YoY); Gross Margin of 47.3%

- Q2 EPS increases to $0.35 from $0.06 YoY; First-half EPS climbs to $0.76 from $0.10

- Adjusted EBITDA up 113% YoY to $15.8M; First-half Adjusted EBITDA up 180% to $33.0M

- Q2 Entra Family DAA sales expand 202% YoY to $55.7M

VICTORIA, BC – (February 9, 2023) – Vecima Networks Inc. (TSX: VCM) today reported financial results for the three and six months ended December 31, 2022.

FINANCIAL HIGHLIGHTS

“Our second quarter performance exceeded our expectations with consolidated sales up 75% year-over-year to a new quarterly record of $76.2 million. Importantly this was also 4% growth over the high-water mark we achieved of 22.5% sequential growth in the first quarter of fiscal 2023,” said Sumit Kumar, President and CEO of Vecima.

“We set a new revenue record for both Entra and the Video and Broadband Solutions segment as deliveries of our EntraOptical Fiber Access solutions continued to ramp up. We entered Q2 anticipating level quarterly revenues as we rebalanced Entra orders following Q1’s exceptionally strong deliveries across our DAA portfolio. Adding to our Q2 results was 13% sequential quarterly growth in our Content Delivery and Storage segment as we supported IPTV network expansions with a number of existing customers.”

“We paired our strong topline performance with adjusted EBITDA of $15.8 million and adjusted earnings per share of $0.35, which were up 113% and 483% year-over-year, respectively. We have now achieved year-to-date Adjusted EBITDA of $33.0 million and adjusted earnings per share of $0.76, exceeding in just six months what we accomplished in all of last year.”

“These results illustrate not just the remarkable demand momentum building for our next-generation DAA and IPTV solutions, but also our success in leveraging our financial and supply chain strengths to successfully and profitably meet our customer needs. During the second quarter we further bolstered our financial position with a successful equity raise and financed growth-fueling working capital that will help us respond to the even stronger demand profile we see for our Entra DAA and IPTV solutions in the second half and beyond,” said Mr. Kumar. “We were also very pleased to see that the response to the equity offering was met with significant demand leading to the private placement upsizing and that investors have a clear thesis on our growth strategy and our responses to market demand and supply chain factors.”

BUSINESS HIGHLIGHTS

Financial and Corporate Highlights

- Achieved a new quarterly revenue record with second quarter sales climbing 75% to $76.2 million, from $43.6 million in Q2 fiscal 2022

- Gross profit climbed 65% to a record $36.0 million, up from $21.8 million last year

- EPS and Adjusted EPS increased six times to $0.35 per share, from $0.06 per share in Q2 fiscal 2022

- Adjusted EBITDA grew 113% to $15.8 million, from $7.4 million in the prior-year period

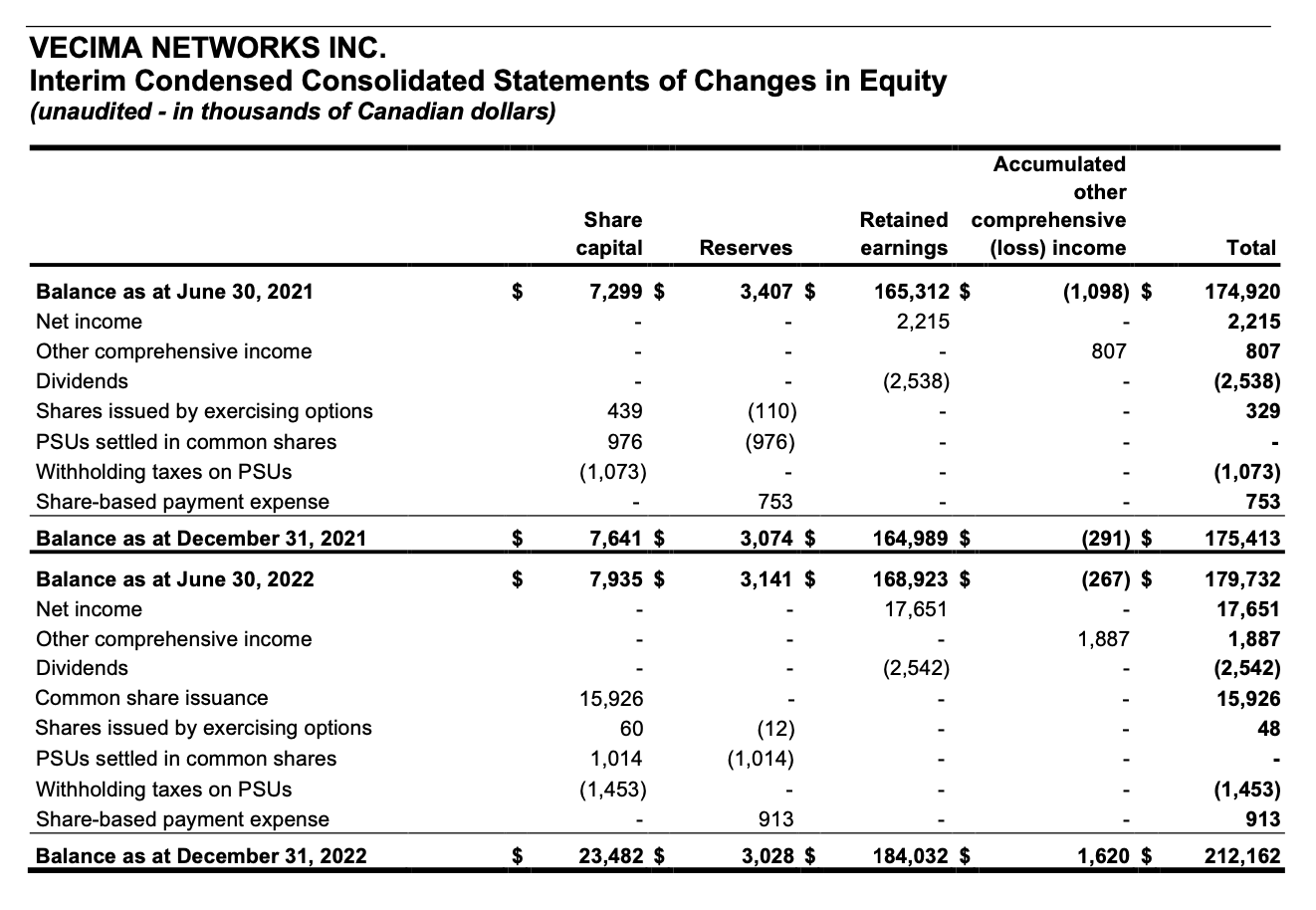

- In December, successfully completed a common share offering, raising gross proceeds of approximately $17.0 million. Proceeds of the offering were used to support working capital requirements as Vecima responds to high demand for its next-generation solutions

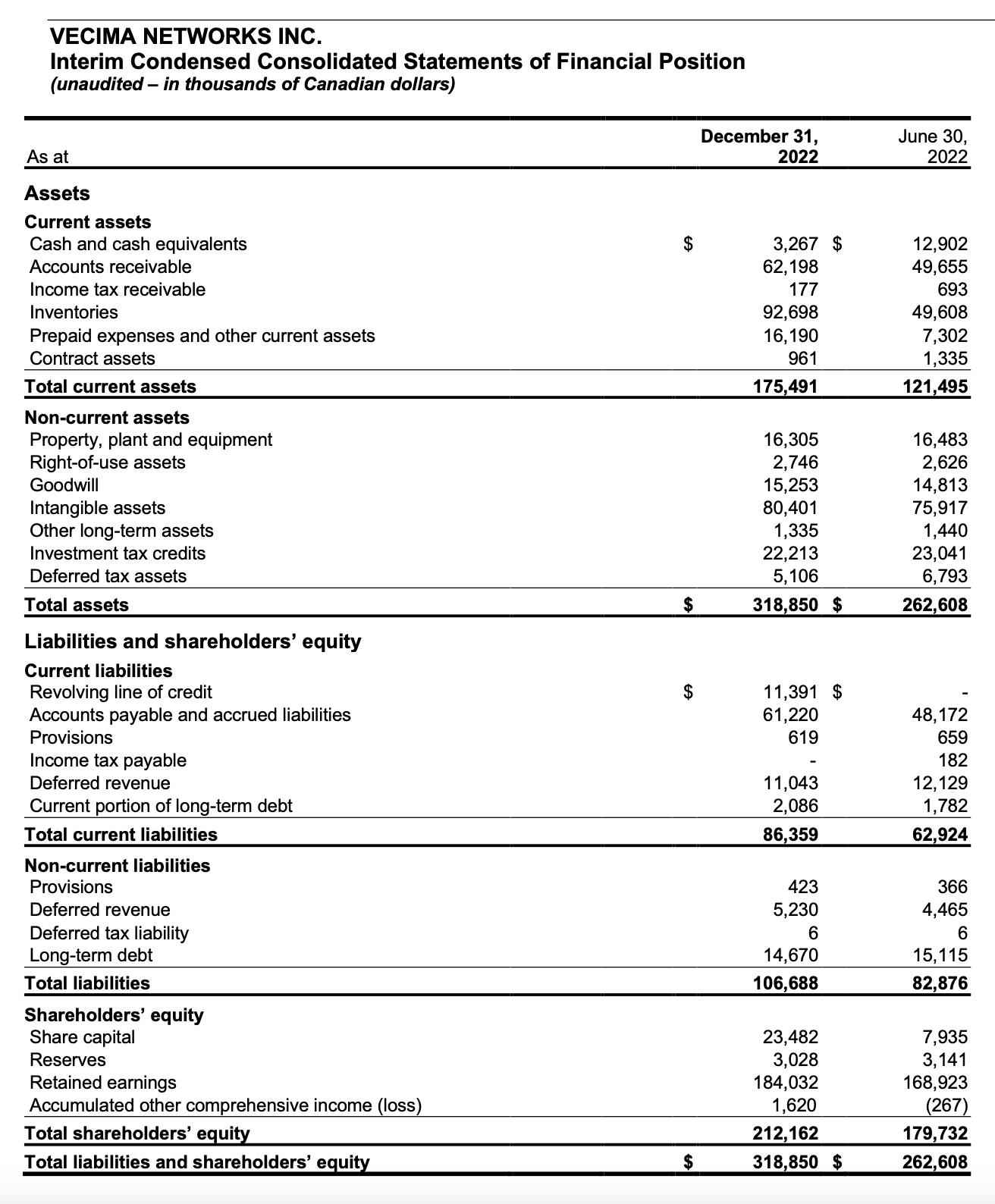

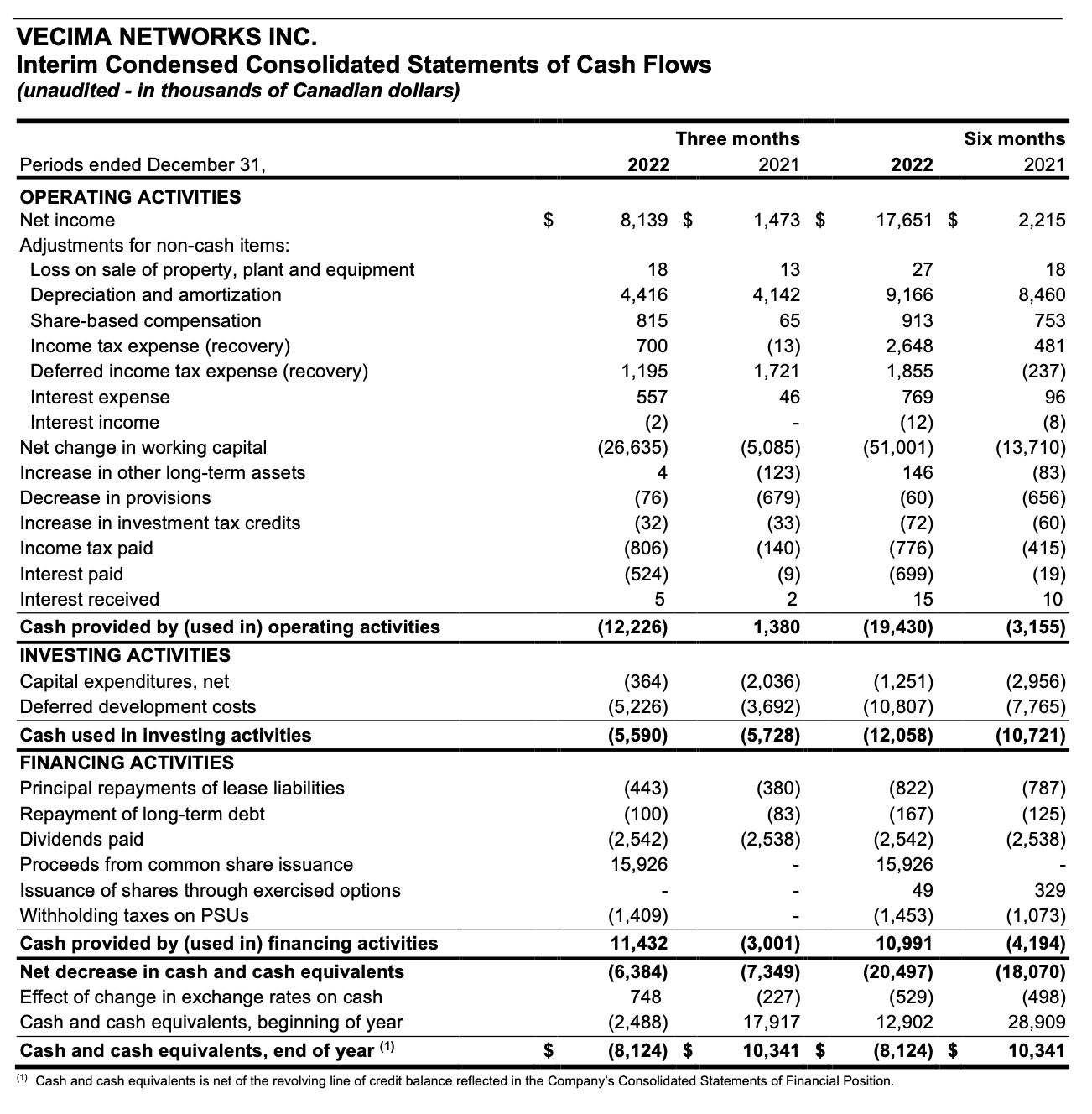

- Ended the second quarter in strong financial position with working capital of $89.1 million at December 31, 2022, compared to $58.6 million at June 30, 2022

Video and Broadband Solutions (VBS)

- The VBS segment delivered record performance of $62.3 million, up 129% year-over-year and 2% higher than the exceptionally strong performance achieved in Q1 fiscal 2023

DAA (Entra family)

-

- Deployments of next-generation Entra DAA products rose to a record $55.7 million, up 202% year-over-year and 5% quarter-over-quarter as customers continued to increase rollout of next-generation distributed access architecture

- Key DAA achievements in Q2 fiscal 2023 included:

- An increase in total customer engagements to 101 MSOs worldwide, from 80 a year earlier. Fifty of these customers are ordering Entra products, with order sizes increasing as broader DAA deployment continues

- Customers engaged for cable access now number 57

- Customers engaged for fiber access or both access technologies now number 44

- Achieved an exceptional quarter for Vecima’s fiber-access DAA solutions, leveraging supply chain strengths to support scale rollouts of EntraOptical Fiber Access solutions, particularly for broadly-funded rural broadband expansions

- Reached a major fiber milestone with a Tier 1 operator in the US, deploying more than 20,000 10G PON (Passive Optical Network) ports of Vecima’s Entra Fiber Access portfolio

- VBS services revenues increased 62% YoY and 6% quarter-over-quarter

- An increase in total customer engagements to 101 MSOs worldwide, from 80 a year earlier. Fifty of these customers are ordering Entra products, with order sizes increasing as broader DAA deployment continues

Commercial Video (Terrace family)

-

- Generated Commercial Video sales of $6.5 million, as compared to $8.7 million in Q2 fiscal 2022 and $7.3 million in Q1 fiscal 2023, as customers prepare to transition to next-generation platforms

- Reached the 25,000-property milestone for Terrace family of products, which services hotels, enterprises and commercial sites throughout the Americas

Content Delivery and Storage (CDS)

- Achieved Q2 CDS sales of $12.4 million, a decrease of 17% from $15.0 million in Q2 fiscal 2022 and an increase of 13% from $11.0 million generated in Q1 fiscal 2023

- Undertook major IPTV expansions with existing customers:

- Grew IPTV deployment with a Tier 2 cable operator in the Midwestern U.S., broadening the network’s footprint to give a larger subscriber base access to state-of-the-art live, on-demand, and cloud DVR streaming services on the IPTV fabric, while further migrating from legacy QAM-based video services

- Expanded capacity of IPTV services with a fiber service provider in the Southeastern U.S. where Vecima’s full MediaScale portfolio is used as the operator’s flagship video offering to households and multiple dwelling units

- Undertook major network capacity expansion at a leading fiber service provider that covers several markets across the United States with a full suite of IPTV services in multi-tenant and multi-dwelling communities

- Initiated digital ad insertion (DAI) sales with multiple customers, paving the way for operators to improve monetization of IP Linear Services

- Supported the record traffic experienced by operators during the FIFA World Cup Qatar 2022™

- A major Tier 1 service provider in Latin America achieved record video streaming viewership and performance during the World Cup using Vecima’s MediaScale unified streaming video solution

- Introduced a new proactive monitoring system and associated service, which successfully achieved 100% uptime for all participating operators during the World Cup

- In collaboration with the Streaming Video Technology Alliance (SVTA) and the Open Caching Testbed Initiative, completed the world’s first successful multi-tenant test of an SVTA Open Caching standards-compliant system using our MediaScale Open CDN system

Telematics

- Awarded new municipal contract with a British Columbia-based municipality, resulting in an award of approximately 100 vehicle subscriptions, including winter operations vehicles

- Achieved best quarter to date for additions of new moveable asset customers, including adding 12 customers for the NERO asset tracking platform, over 200 additional subscriptions booked, and asset tracking-related telematics subscriptions now representing approximately 7.5% of total subscriptions

- Significantly increased the number of moveable assets being monitored to over 35,000 units, an over 200% increase in the last seven quarters

- Achieved gross margin percentage of 67.6%

“Communities and the operators that support them are on a path to building the fast, reliable, and ubiquitous broadband connections that will usher in a new generation of networks, networks that we believe are the very foundation of global progress. Vecima’s anticipation of this movement along with our steadfast investments to develop leading portfolios of cable and fiber access technology and solutions that deliver this very connectivity are paying dividends, today and tomorrow. With scale deployment ramping up with multiple customers in parallel, and a vast pipeline of customer purchase orders and forecasts providing excellent visibility, we anticipate the strong growth experienced in the first half will continue to build in the second half of fiscal 2023 and beyond,” said Mr. Kumar. “We have positioned ourselves for ongoing success by increasing our investment in working capital in tandem with market demand, particularly in the form of raw material and finished goods inventories, to support this growth.”

“In our Content Delivery and Storage segment, our large base of IPTV customers is providing an inbuilt platform for growth as operators begin to initiate IPTV network expansions. While we continue to anticipate moderate sales growth for this segment in fiscal 2023, over the medium-to-longer term we see significantly higher growth potential as IPTV gains momentum and as demand for our newer open caching solutions continues to build.”

“Overall, we remain highly confident in Vecima’s ability to capture the major and multi-year opportunities in the fast-growing DAA and IPTV markets,” said Mr. Kumar.

As previously reported, Vecima’s Board of Directors declared a quarterly dividend of $0.055 per share for the period. The dividend will be payable on March 27, 2023 to shareholders of record as at February 24, 2023.

CONFERENCE CALL

A conference call and live audio webcast will be held today, February 9, 2023 at 1 p.m. ET to discuss the Company’s second quarter results. Vecima’s unaudited interim condensed consolidated financial statements and management’s discussion and analysis for the three and six months ended December 31, 2022 are available under the Company’s profile at www.SEDAR.com, and at http://vecima.com/investor-relations/financial-reports/.

To participate in the teleconference, dial 1-800-319-4610 or 1-604-638-9020. The webcast will be available in real time at http://services.choruscall.ca/links/vecima2023q2.html and will be archived on the Vecima website at http://vecima.com/investor-relations/earnings-call-archive/

About Vecima Networks

Vecima Networks Inc. (TSX: VCM) is leading the global evolution to the multi-gigabit, content-rich networks of the future. Our talented people deliver future-ready software, services, and integrated platforms that power broadband and video streaming networks, monitor and manage transportation, and transform experiences in homes, businesses, and everywhere people connect. We help our customers evolve their networks with cloud-based solutions that deliver ground-breaking speed, superior video quality, and exciting new services to their subscribers. There is power in connectivity – it enables people, businesses, and communities to grow and thrive. Learn more at www.vecima.com.

Adjusted EBITDA and Adjusted Earnings/(Loss) Per Share

Adjusted EBITDA and Adjusted Earnings (Loss) Per Share do not have a standardized meaning under IFRS and therefore may not be comparable to similar measures provided by other issuers. Accordingly, investors are cautioned that Adjusted EBITDA or Adjusted Earnings (Loss) Per Share should not be construed as an alternative to net income, determined in accordance with IFRS, as an indicator of the Company’s financial performance or as a measure of its liquidity and cash flows. For a reconciliation of Adjusted EBITDA or Adjusted Earnings (Loss) Per Share, investors should refer to Vecima’s Management’s Discussion and Analysis for the second quarter of fiscal 2023.

Forward-Looking Statements

This news release contains “forward-looking information” within the meaning of applicable securities laws. Forward-looking information is generally identifiable by use of the words “believes”, “may”, “plans”, “will”, “anticipates”, “intends”, “could”, “estimates”, “expects”, “forecasts”, “projects” and similar expressions, and the negative of such expressions. Forward-looking information in this news release includes the following statements: our second quarter performance exceeded our expectations; we entered Q2 anticipating level quarterly revenues as we rebalanced Entra orders; these results illustrate not just the remarkable demand momentum building; we further bolstered our financial position that will help us respond to the even stronger demand profile we see for our Entra DAA and IPTV solutions in the second half and beyond; we were also very pleased to see that the response to the equity offering was met with significant demand leading to the private placement upsizing and that investors have a clear thesis on our growth strategy and our responses to market demand and supply chain factors; Vecima responds to high demand for its next-generation solutions; customers are ordering Entra products, with order sizes increasing as broader DAA deployment continues; communities and the operators that support them are on a path to building the fast, reliable, and ubiquitous broadband connections that will usher in a new generation of networks, networks that we believe are the very foundation of global progress; Vecima’s anticipation of this movement along with our steadfast investments to develop leading portfolios of cable and fiber access technology and solutions that deliver this very connectivity are paying dividends, today and tomorrow; with scale deployment ramping up with multiple customers in parallel, and a vast pipeline of customer purchase orders and forecasts providing excellent visibility, we anticipate the strong growth experienced in the first half will continue to build in the second half of fiscal 2023 and beyond; we have positioned ourselves for ongoing success by increasing our investment in working capital in tandem with market demand, particularly in the form of raw material and finished goods inventories, to support this growth; our large base of IPTV customers is providing an inbuilt platform for growth as operators begin to initiate IPTV network expansions; we continue to anticipate moderate sales growth for this segment in fiscal 2023; over the medium-to-longer term we see significantly higher growth potential as IPTV gains momentum and as demand for our newer open caching solutions continues to build; we remain highly confident in Vecima’s ability to capture the major and multi-year opportunities in the fast-growing DAA and IPTV markets.”

A more complete discussion of the risks and uncertainties facing Vecima is disclosed under the heading “Risk Factors” in the Company’s Annual Information Form dated September 22, 2022, as well as the Company’s continuous disclosure filings with Canadian securities regulatory authorities available at www.sedar.com. All forward-looking information herein is qualified in its entirety by this cautionary statement, and Vecima disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events or developments, except as required by law.

Vecima Networks

Investor Relations – 250-881-1982

Back to all Press Releases

Contact Investor Relations

Vecima Networks Inc.

201-771 Vanalman Avenue, Victoria, BC V8Z-3B8. Canada

Phone: (250) 881-1982 Fax: (250) 881-1974

Email: invest@vecima.com