Vecima Reports Q1 Fiscal 2020 Results

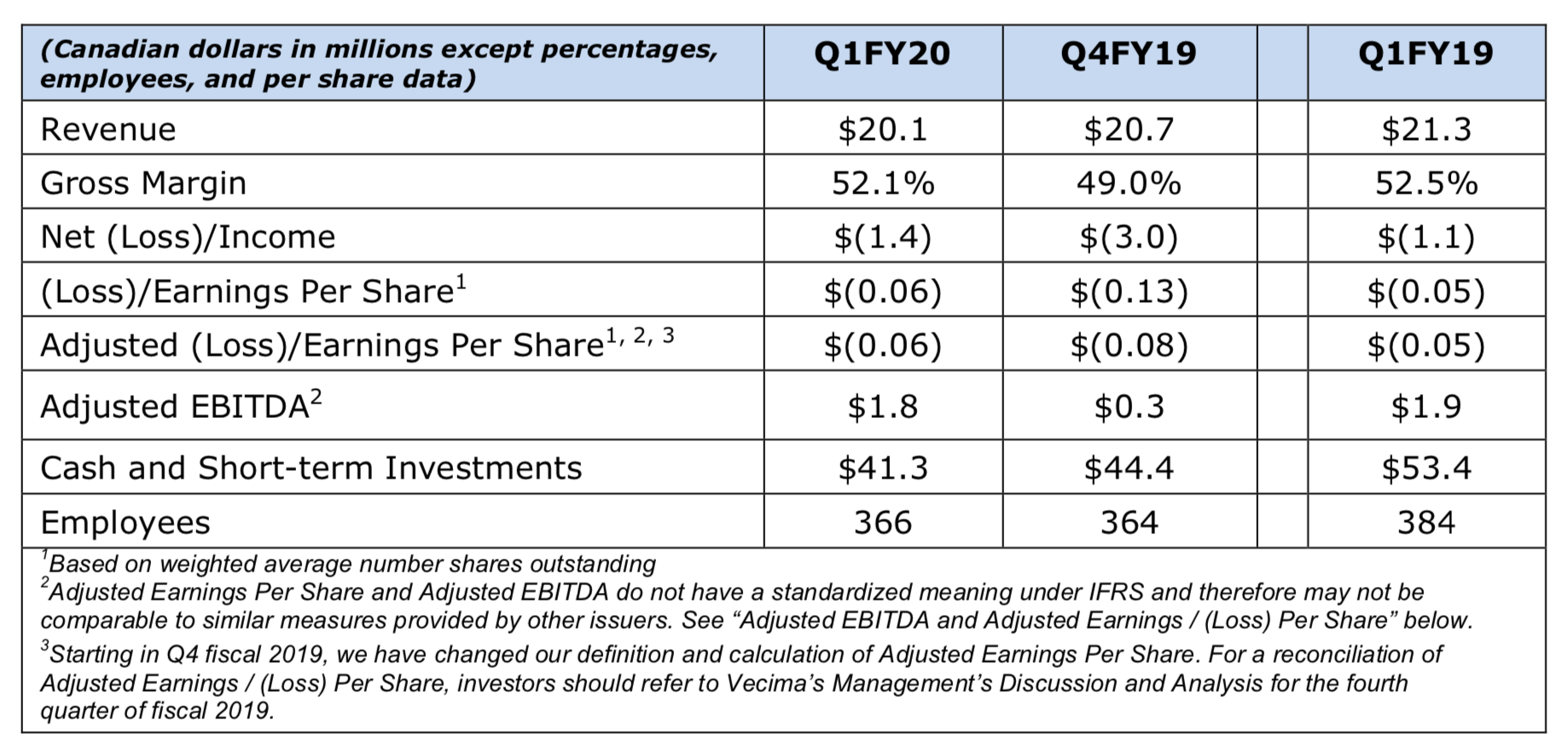

- Revenue – $20.1M, Gross Margin 52.0%, Cash Balance: $41.3M

- Achieved 31% YOY sales growth in Content Delivery and Storage segment and added Tier 1 IPTV customer

- Further expansion of Entra family

- Received first order for Entra Video QAM Manager

VICTORIA, BC – (November 14, 2019) – Vecima Networks Inc. (TSX:VCM), today reported financial results for the three months ended September 30, 2019.

FINANCIAL HIGHLIGHTS

“Fiscal 2020 got off to a fast and productive start as we moved closer to commercial rollout of our Entra family of Distributed Access Architecture (DAA) products, benefitted from growing demand for our MediaScaleX family of Content Delivery and Storage solutions, and continued to expand our product ecosystems in line with the growing opportunities in DAA and IPTV,” said Sumit Kumar, Vecima’s President and Chief Executive Officer.

“On the Entra front, we stepped significantly forward in our DAA engagements. Nineteen MSOs are now in various stages of lab and field trials with our new DAA products, and as previously announced, we signed a Master Purchase Agreement with a Tier 1 customer for our Entra Remote PHY Nodes and Monitor products in the first quarter. I am delighted to announce that we also received our first customer order for our new Entra Video QAM Manager during the quarter, an important milestone on our path to commercialization. At the same time, we continued to expand our DAA ecosystem with the launch of our new Entra Interactive Video Controller and further enhanced our industry leadership position with the announcement of a new double-density Remote PHY node.”

“In our Content Delivery and Storage segment, we achieved 31% year-over-year revenue growth, despite Q1 being the seasonally slowest period for this part of our business. Our performance underscores the strong demand for our MediaScaleX solutions, as well as our success in building our customer base in the expanding IPTV market. During the first quarter, we added three new customers including a Tier 1 MSO in Latin America, and two additional operators in North America.”

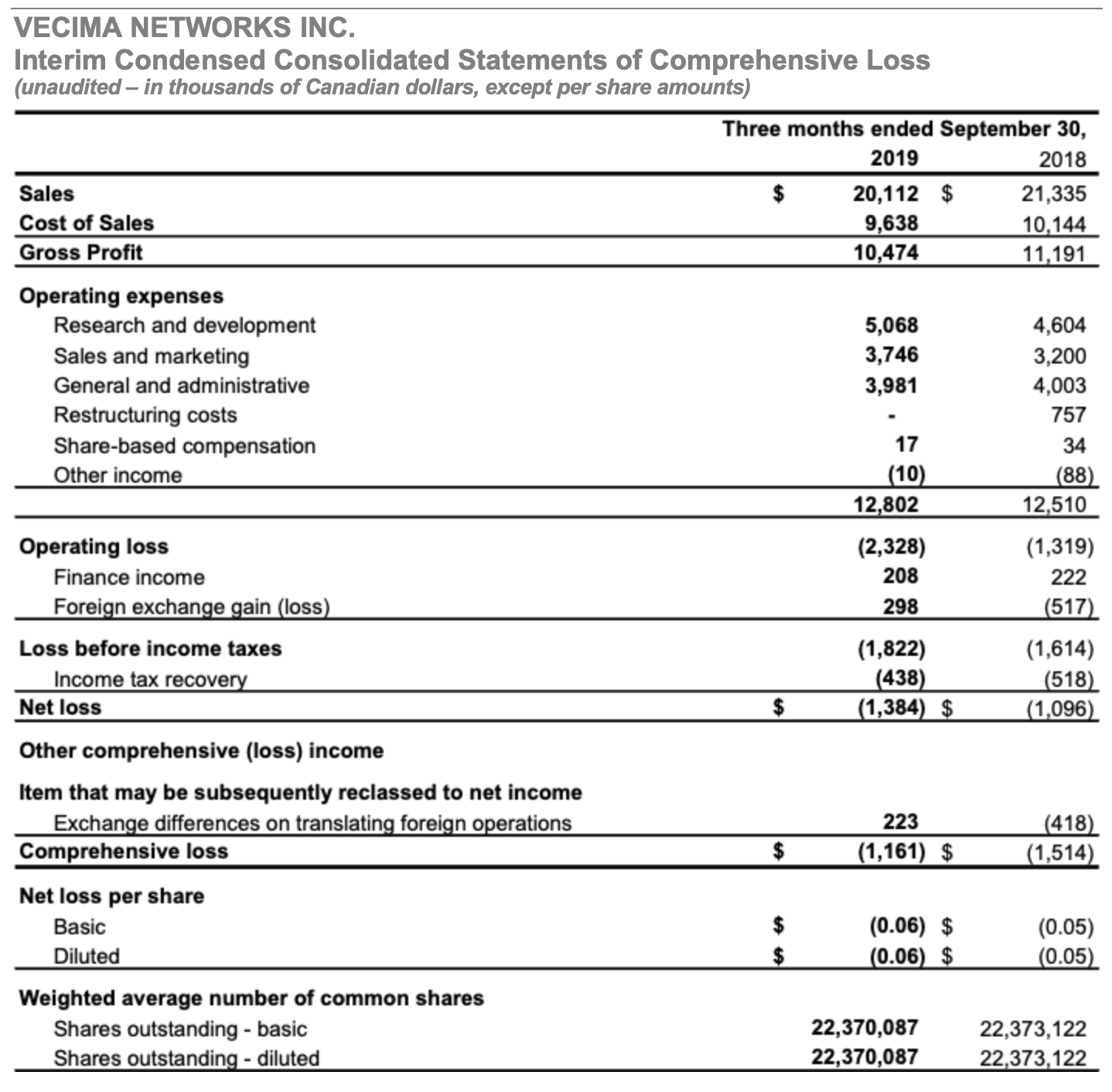

Financially, Vecima achieved first quarter revenues of $20.1 million, as compared to $21.3 million in Q1 Fiscal 2019. While the Content Delivery and Storage segment achieved strong year-over-year growth, this was offset by declining demand for legacy products in the Video and Broadband Solutions segment as customers prepare to transition to the next-generation DAA platforms, which the Company anticipates to be close at hand.

BUSINESS HIGHLIGHTS

Video and Broadband Solutions

- Continued progress towards commercial rollout of Entra™ family of Distributed Access Architecture (DAA) products:

- Intensified engagement with Tier 1 customer following previously announced signing of Master Purchase Agreement for Remote PHY nodes and made significant progress in approval process and deployment plan with this customer

- Entra Video QAM Manager (VQM) honoured with four diamonds at Broadband Technology Report’s (BTR) 2019 Diamond Technology Review Awards. The four diamond rating represents an “excellent product with technical features and performance that provide clear and substantiated benefits”

- Subsequent to the quarter end, received first order for recently launched Entra Video QAM Manager from a Tier 2 MSO

- Furthered distributed access engagement with a Tier 1 MSO to include integrated proposals encompassing both DAA and IPTV deployments

- Further expansion of Entra product portfolio:

- Launched Entra Interactive Video Controller (IVC), a headend device that provides essential two-way network connectivity for heavily deployed set-top boxes enabling them to support Video on Demand, Switched Digital Video and other functionalities within both DAA and traditional RF network architectures

- Early in October, announced an industry-leading and innovative, high-density DAA node with addition of the Entra EN8124 node, which supports two Remote PHY Devices (RPD) in a single node to double both downstream and upstream capacity. Concurrently achieved Viavi Gold Certification for the Entra Remote PHY node, enabling HFC quality measurement capabilities within the DAA architecture that are mission critical to MSOs

Content Delivery and Storage

- Achieved 31% year-over-year revenue growth driven by new customers and expansion with existing customers

- Continued expansion into IPTV market with 20 operators now using Vecima platforms to deliver IP video

- Signed agreement for CDN deployment for an IPTV network with Tier 1 MSO operating across Latin America and the Caribbean

- Conway Corporation, a North American cable provider, selected Vecima’s MediaScaleX™ solution to power its new IPTV multiscreen service as it moves from QAM to IP delivery systems

- Expanded IP Linear and On Demand platform with European Tier 1 MSO

- Successfully integrated the new “ContentAgent” video ingest and delivery automation solutions business acquired by Vecima in May 2019. ContentAgent is used by world-leading story tellers in the creation of their productions, orchestrating the entire workflow all the way from camera ingest to publishing

- MediaScaleX//Storage™ honored with 2019 Broadband Technology Report (BTR) Diamond Technology Review Awards, receiving four Diamonds. MediaScaleX//Storage is a video-optimized, software-defined storage platform that is differentiated for massive scale IPTV with leading burst I/O performance and a hybrid flash and disk architecture that delivers flash performance at disk costs

- Initiated sales of a major software release upgrade with a world top-five MSO where MediaScaleX is deployed to provide on-demand video across over 75% of the operator’s footprint. Sales to this customer are expected to be robust in FY20 as the upgrade program continues

- MediaScaleX ecosystem expanded to include new integration partners in customer premise equipment and back-office solutions, widening customer choice for IPTV

Telematics

- Continued incremental growth in fleet management and moveable assets market

- Increased penetration in the moveable assets market, with the addition of six new restoration industry customers. Over 2,000 assets now being monitored with Vecima’s Bluetooth Low Energy (BLE) tags

“Vecima’s momentum is building,” added Mr. Kumar. “The global IPTV opportunity is burgeoning and we are capitalizing on it with our powerful MediaScaleX family of products. We continue to see the potential for year-over-year revenue growth of over 20% in our Content Delivery and Storage segment in fiscal 2020. At the same time, our portfolio of highly differentiated Entra DAA solutions is creating multiple near-term opportunities in the Video and Broadband Solutions segment where we are on the precipice of making DAA a reality. We are exceptionally well positioned to capitalize on these opportunities and expect fiscal 2020 will be a pivotal year for Vecima.”

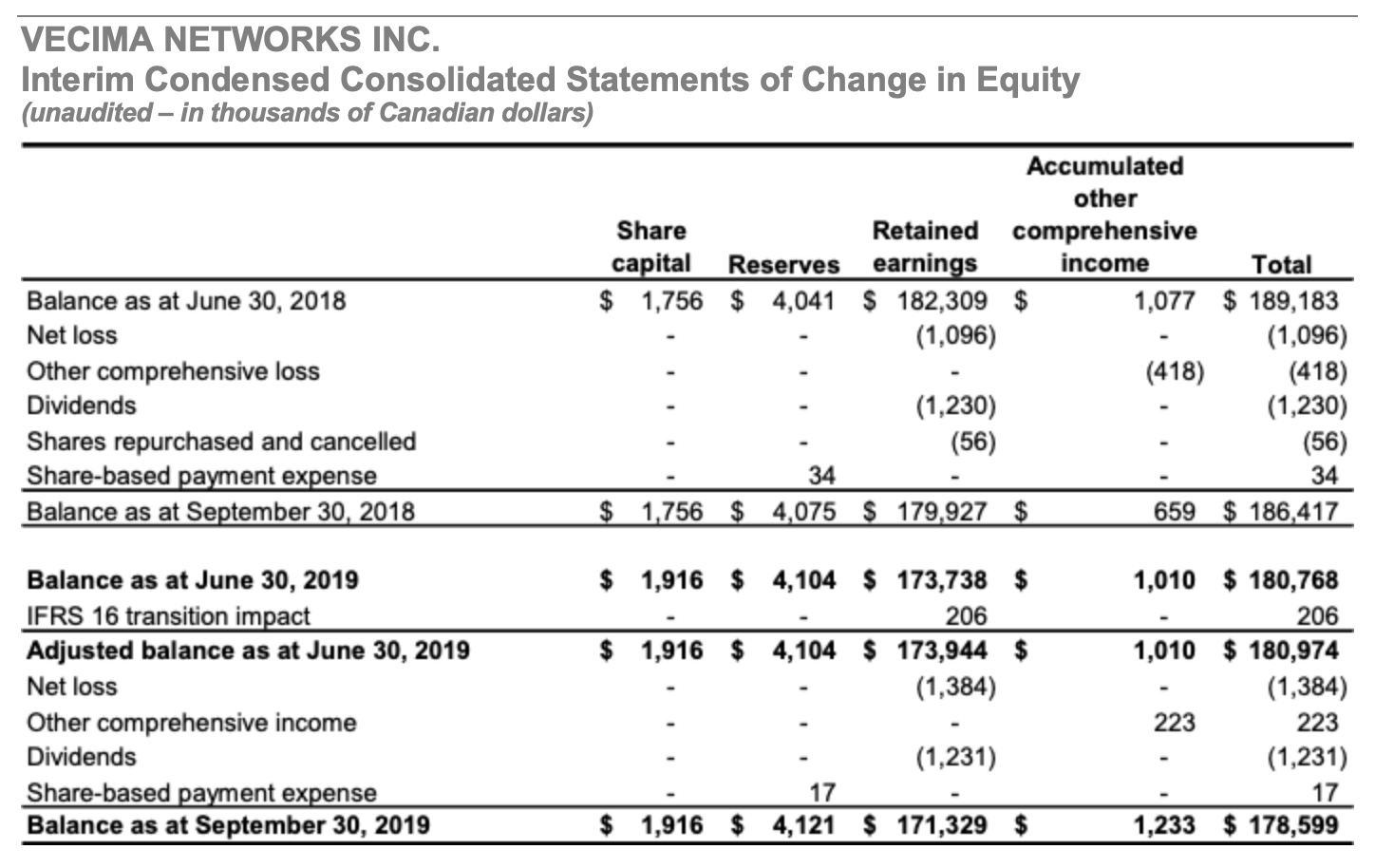

As previously reported, Vecima’s Board of Directors declared a quarterly dividend of $0.055 per share for the period. The dividend will be payable on December 23, 2019 to shareholders of record as at November 29, 2019.

CONFERENCE CALL

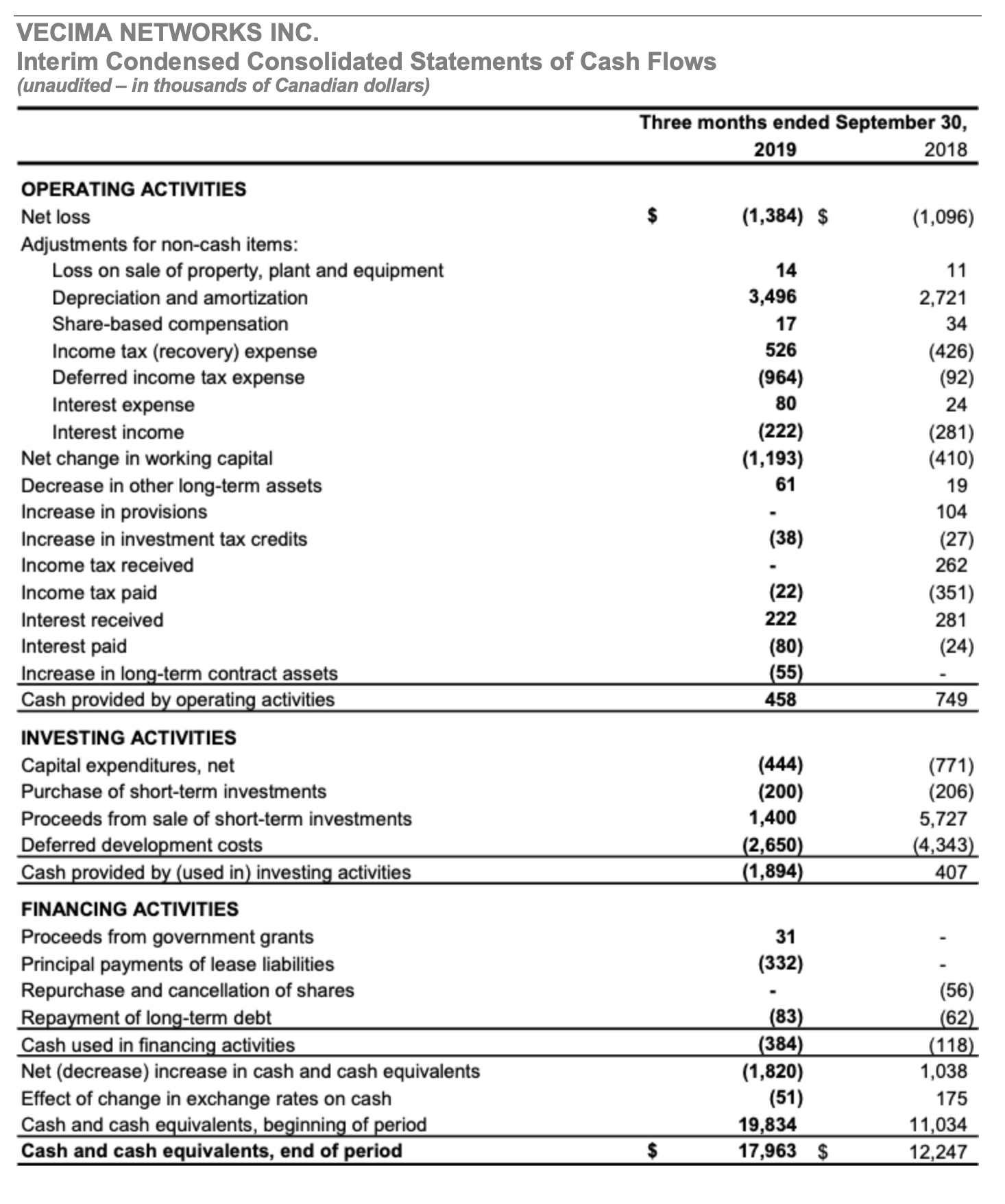

A conference call and live audio webcast will be held today, November 14, 2019 at 1 p.m. ET to discuss the Company’s first quarter results. Vecima’s unaudited interim condensed consolidated financial statements and management’s discussion and analysis for the three months ended September 30, 2019 are available under the Company’s profile at www.SEDAR.com, and at www.vecima.com/financials/.

To participate in the teleconference, dial 1-800-319-4610 or 1-604-638-9020. The webcast will be available in real time at http://services.choruscall.ca/links/vecima20191114.html and will be archived on the Vecima website at http://vecima.com/investor-relations/earnings-call-archive/

About Vecima Networks

Vecima Networks Inc. is a global leader focused on developing integrated hardware and scalable software solutions for broadband access, content delivery, and telematics. We enable the world’s leading innovators to advance, connect, entertain, and analyze. We build technologies that transform content delivery and storage, enable high‑capacity broadband network access, and streamline data analytics. For more information, please visit our website at www.vecima.com.

Adjusted EBITDA and Adjusted Earnings / (Loss) Per Share

Adjusted EBITDA and Adjusted Earnings / (Loss) Per Share do not have a standardized meaning under IFRS and therefore may not be comparable to similar measures provided by other issuers. Accordingly, investors are cautioned that Adjusted EBITDA or Adjusted Earnings / (Loss) Per Share should not be construed as an alternative to net income, determined in accordance with IFRS, as an indicator of the Company’s financial performance or as a measure of its liquidity and cash flows. For a reconciliation of Adjusted EBITDA or Adjusted Earnings / (Loss) Per Share, investors should refer to Vecima’s Management’s Discussion and Analysis for the first quarter of fiscal 2020.

Forward-Looking Statements

This news release contains “forward-looking information” within the meaning of applicable securities laws. Forward-looking information is generally identifiable by use of the words “believes”, “may”, “plans”, “will”, “anticipates”, “intends”, “could”, “estimates”, “expects”, “forecasts”, “projects” and similar expressions, and the negative of such expressions. Forward-looking information in this news release includes the following statements: Further expansion of Entra family; Fiscal 2020 got off to a fast and productive start as we moved closer to commercial rollout of our Entra family of Distributed Access Architecture (DAA) products, benefitted from growing demand for our MediaScaleX family of Content Delivery and Storage solutions, and continued to expand our product ecosystems in line with the growing opportunities in DAA and IPTV; On the Entra front, we stepped significantly forward in our DAA engagements; Our performance underscores the strong demand for our MediaScaleX solutions, as well as our success in building our customer base in the expanding IPTV market; While the Content Delivery and Storage segment achieved strong year-over-year growth, this was offset by declining demand for legacy products in the Video and Broadband Solutions segment as customers prepare to transition to the next-generation DAA platforms, which the company anticipates to be close at hand; Intensified engagement with Tier 1 customer following previously announced signing of Master Purchase Agreement for Remote PHY nodes and made significant progress in approval process and deployment plan with this customer; Furthered distributed access engagement with a Tier 1 MSO to include integrated proposals encompassing both DAA and IPTV deployments; Initiated sales of a major software release upgrade with a world top-five MSO where MediaScaleX is deployed to provide on-demand video across over 75% of the operator’s footprint. Sales to this customer are expected to be robust in FY20 as the upgrade program continues; Continued incremental growth in fleet management and moveable assets market; Vecima’s momentum is building; The global IPTV opportunity is burgeoning and we are capitalizing on it with our powerful MediaScaleX family of products; We continue to see the potential for year-over-year revenue growth of over 20% in our Content Delivery and Storage segment in fiscal 2020; At the same time, our portfolio of highly differentiated Entra DAA solutions is creating multiple near-term opportunities in the Video and Broadband Solutions segment where we are on the precipice of making DAA a reality; We are exceptionally well positioned to capitalize on these opportunities and expect fiscal 2020 will be a pivotal year for Vecima.

A more complete discussion of the risks and uncertainties facing Vecima is disclosed under the heading “Risk Factors” in the Company’s Annual Information Form dated September 26, 2019, as well as the Company’s continuous disclosure filings with Canadian securities regulatory authorities available at www.sedar.com. All forward-looking information herein is qualified in its entirety by this cautionary statement, and Vecima disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events or developments, except as required by law.

Vecima Networks

Investor Relations – 250-881-1982

invest@vecima.com

Back to all Press Releases

Contact Investor Relations

Vecima Networks Inc.

201-771 Vanalman Avenue, Victoria, BC V8Z-3B8. Canada

Phone: (250) 881-1982 Fax: (250) 881-1974

Email: invest@vecima.com