Vecima Reports Full-Year and Q4 Fiscal 2023 Results

Rapid growth in revenue, adjusted EBITDA and adjusted EPS achieved in FY23 as market adoption of DAA and IPTV grows

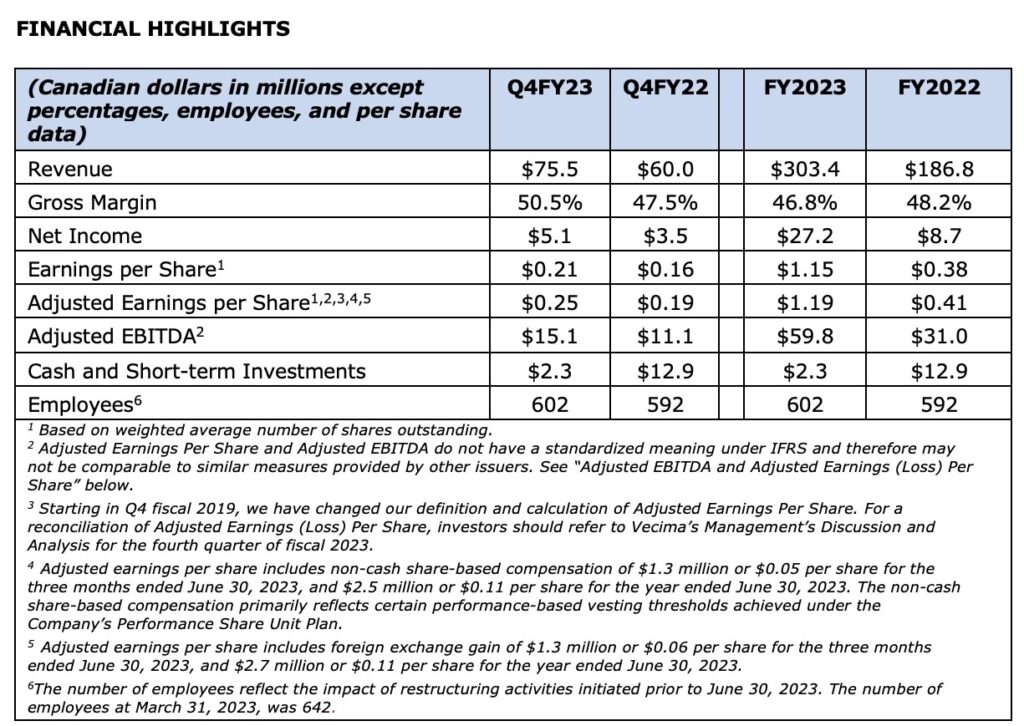

- Annual revenue up 62.4% YoY to $303.4M; Q4 revenue up 26.0% YoY to $75.5M

- Entra DAA sales increase 107% to $222.1M in FY23, and climb 27% YoY to $50.7M in Q4

- Content Delivery and Storage sales grow 20% to $52.3M with Q4 sales of $17.1M, an all-time quarterly record

- FY23 gross margin of 46.8%; Q4 gross margin of 50.5%

- Adjusted EBITDA up 92.8% to $59.8M in FY23; Q4 Adjusted EBITDA up 35.7% YoY to $15.1M

- Adjusted EPS climbs to a record $1.19 in FY23 and $0.25 in Q4

VICTORIA, BC – (September 21, 2023) – Vecima Networks Inc. (TSX: VCM) today reported financial results for the three months and year ended June 30, 2023.

“Fiscal 2023 was an outstanding year for Vecima as we furthered our position as a leading innovator and essential partner supporting the global service provider industry’s wide-scale migration to distributed access architecture and IPTV,” said Sumit Kumar, Vecima’s President and Chief Executive Officer.

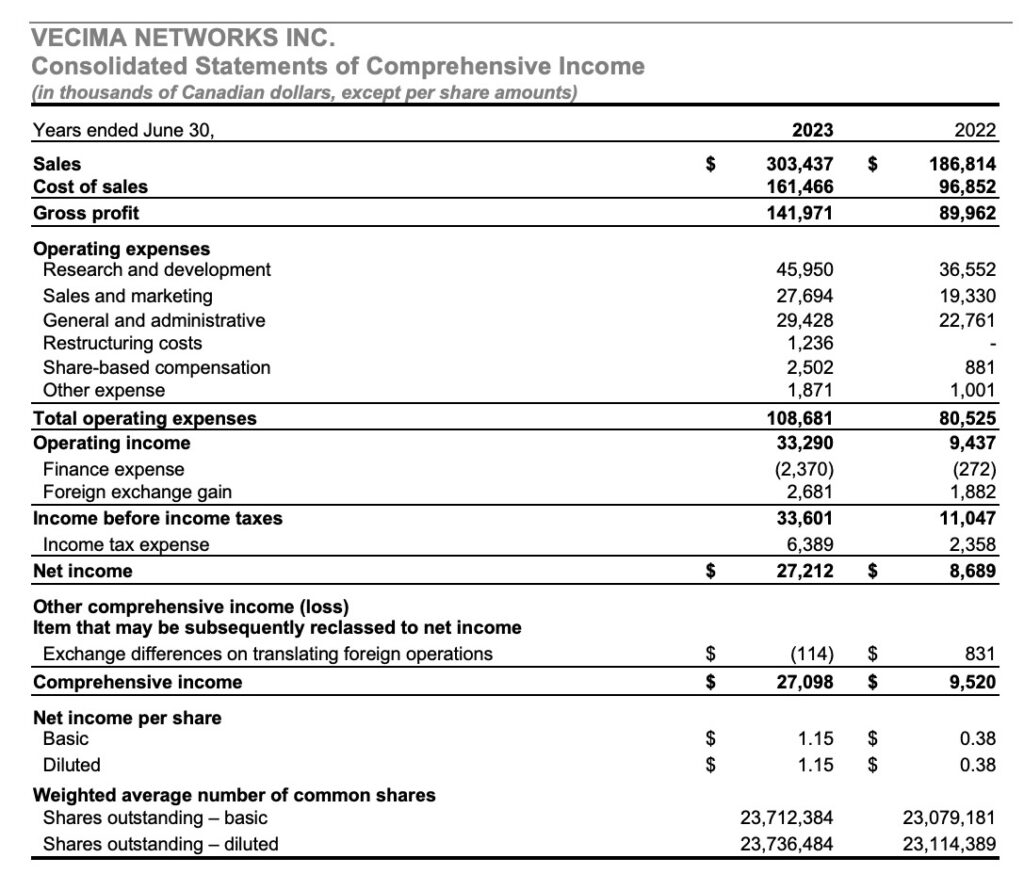

“We decisively bested fiscal 2022’s already stellar performance, turning in the strongest results in Vecima’s history across both the top and bottom lines. Full-year revenue climbed 62.4% to $303.4 million, gross profit was up 57.8% to $142.0 million, adjusted EBITDA grew 92.8% to an all-time high of $59.8 million and adjusted earnings per share increased 190.2% to $1.19 per share, breaking records across the board.”

“Our results included a more than doubling of Entra DAA sales to $222.1 million, underscoring the success of our investment in the industry’s most complete and comprehensive portfolio of interoperable DAA fiber and cable access solutions. We continued to expand that portfolio with major product advances on both the fiber and cable access fronts during the year, while also broadening our customer base and geographies with new wins in North America, Europe, and Asia. Our Entra DAA solutions are now in use by 51 customers worldwide, including eight of North America’s top twelve largest cable operators, and the scope of DAA technologies we have shipped represents capacity for reliable, high-speed service to over 25 million homes.”

“Our fiscal 2023 DAA achievements included a significant expansion of key customer relationships, including Charter Communications’ selection of our new Entra ERM3 Remote PHY solution to support its fixed broadband network evolution to 10G. We expect our solution will be used for a substantial portion of Charter’s planned footprint-wide cable access network upgrade commencing in 2024. We also partnered with Charter to successfully demonstrate 10G-capable, multi-gigabit DOCSIS 4.0, and subsequent to the year-end, we announced a warrant agreement which gives Charter the opportunity to purchase up to 361,050 of our common shares at a pre-determined price, based on the achievement of significant multi-year spending targets. Collectively, these developments underscore the growth of our partnership with one of the world’s largest cable operators as we together execute a broad network evolution strategy.”

“On the IPTV front, our Content Delivery and Storage business turned in impressive performance with 20% year-over-year revenue growth supported by all-time record fourth quarter results. Milestones for the CDS segment included multiple IPTV expansions with existing customers, new customer wins, and the launch of new next-generation MediaScale solutions.”

“We are deeply proud of our fiscal 2023 achievements, even more given the fast-changing supply chain dynamics we faced during the year. For over two years, our response to global component shortages has been highly effective to the extent that Vecima’s solutions were never the critical path preventing customer network upgrades. And now, customers are working to catch up on and ramp projects using the inventories we had unlocked for them through our strong supply chain strategies and disciplined operating management that enabled us to respond effectively to a challenging macroenvironment and achieve exceptional results,” said Mr. Kumar.

BUSINESS HIGHLIGHTS

Financial and Corporate

- Full-year consolidated sales climbed 62.4% year-over-year, setting a new Company record at $303.4 million. Fourth quarter sales grew 26.0% year-over-year to $75.5 million.

- Full-year gross profit of $142.0 million and fourth quarter gross profit of $38.1 million were up 57.8% and 33.8%, respectively, from the same periods in fiscal 2022.

- Achieved full-year gross profit margin of 46.8% and Q4 gross profit margin of 50.5%, as compared to 48.2% and 47.5% in the same periods of fiscal 2022.

- Full-year adjusted EBITDA climbed 92.8% to $59.8 million; Q4 adjusted EBITDA increased 35.7% year-over-year to $15.1 million. As a percentage of revenue, Q4 adjusted EBITDA increased to 20.0% from 18.5% in Q4 fiscal 2022.

- Full-year adjusted EPS grew to a record $1.19 per share, from $0.41 in fiscal 2022; Q4 adjusted EPS grew to $0.25 per share, from $0.19 in Q4 fiscal 2022.

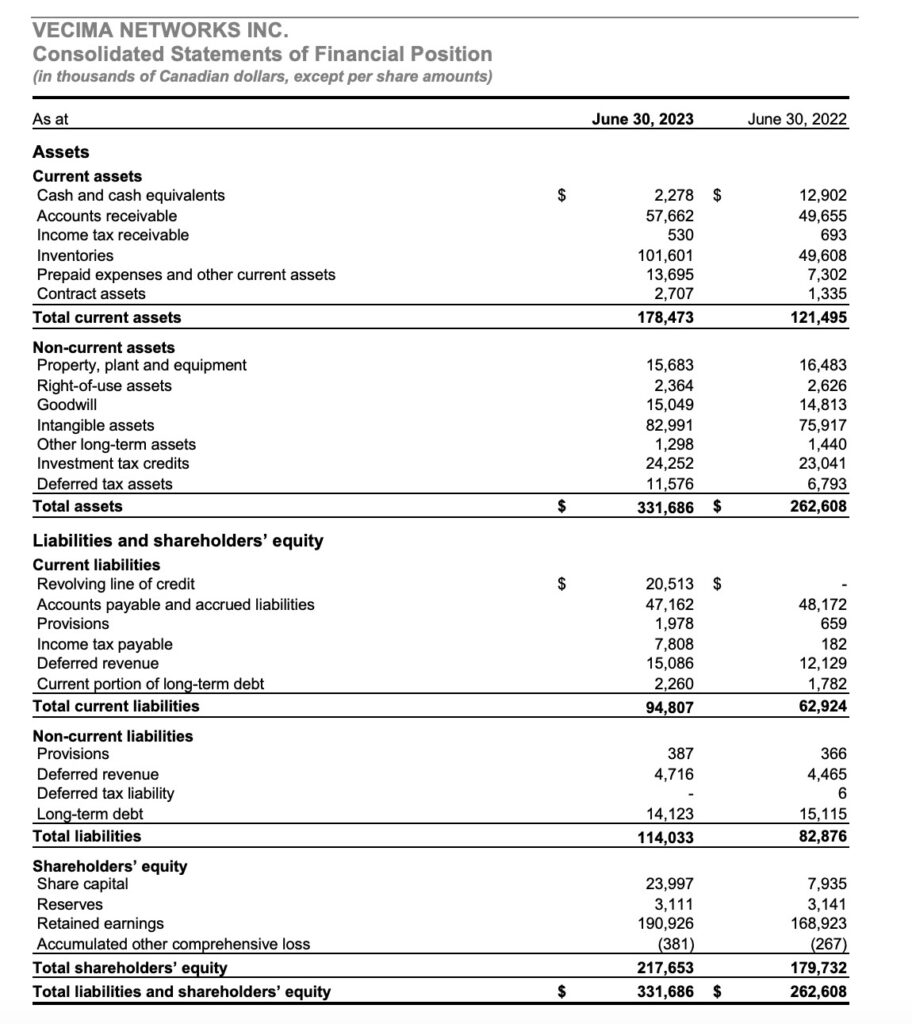

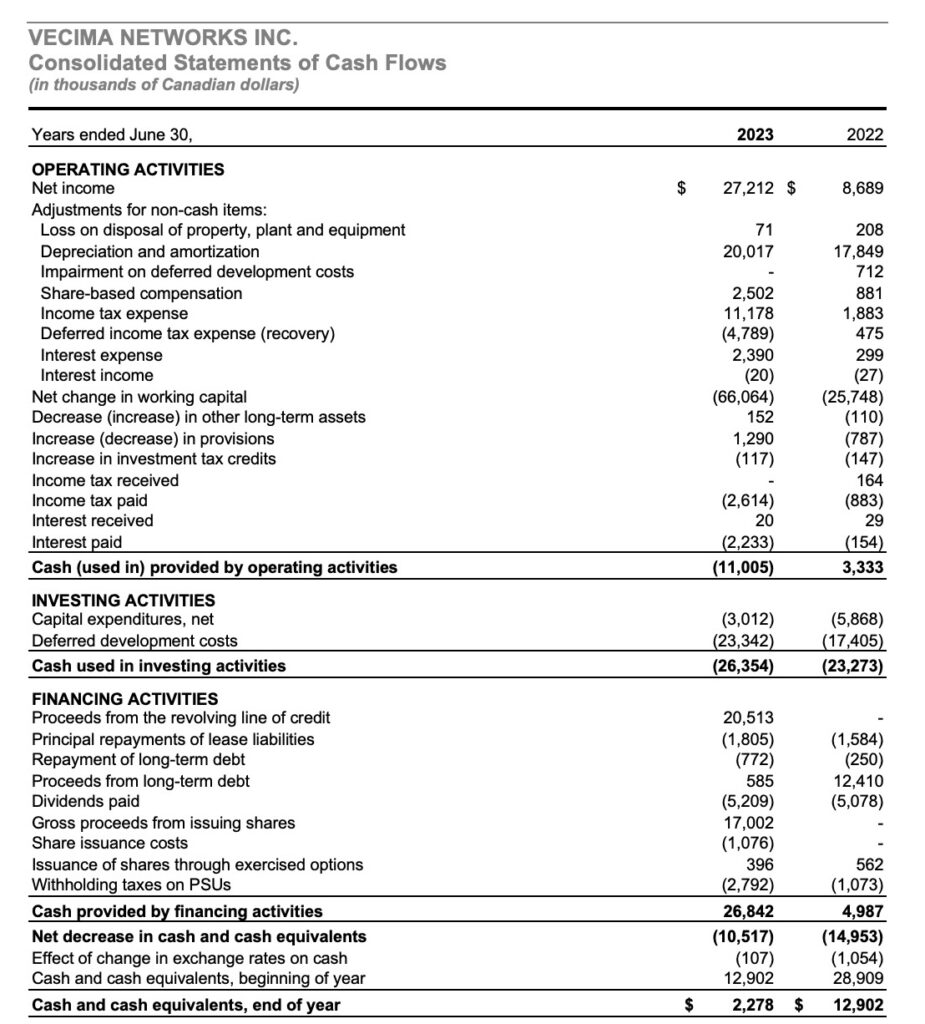

- Ended the fiscal year in strong financial position with $2.3 million in cash and working capital of $83.7 million at June 30, 2023, compared to $12.9 million and $58.6 million, respectively, at June 30, 2022.

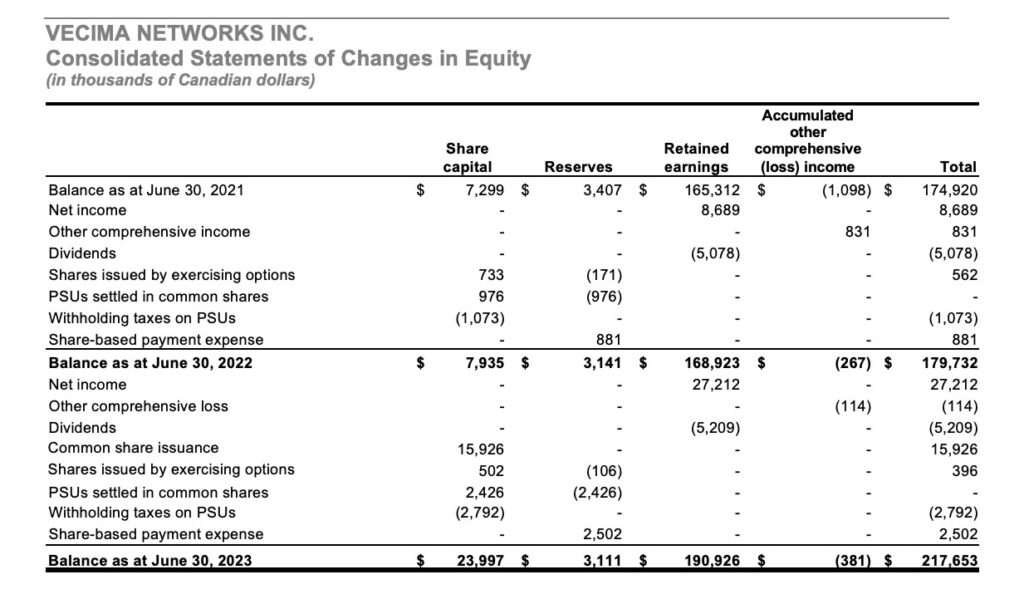

- Declared annual dividends of $0.22 per share, including a fourth quarter dividend of $0.055 per share payable on November 6, 2023 to shareholders of record on October 13, 2023. This represents a cumulative $45 million returned to shareholders through regular dividends since Vecima initiated dividends in October 2014.

Video and Broadband Solutions (VBS)

- Achieved strong segment sales growth with annual VBS revenue increasing 77.7% year-over-year to a record $245.1 million and Q4 VBS sales climbing 15.4% year-over-year to $57.0 million. VBS services revenues increased 44.9% to $15.1 million for the full year and 25.5% to $3.6 million in Q4.

DAA (Entra family)

- Deployments of next-generation Entra DAA products increased 107% year-over-year to $222.1 million in FY23; Q4 Entra sales increased 26.8% year-over-year to $50.7 million.

- Milestone DAA achievements in fiscal 2023 included:

-

- An increase in total customer engagements to 107 MSOs worldwide, from 91 a year earlier. Fifty-one of these customers have now ordered Entra products, with order sizes increasing as operators continue to transition to broader deployment.

- Customers engaged for cable access now number 61.

- Customers engaged for fiber (or both cable and fiber) access technologies now number 46.

-

- Achieved significant market adoption of next-generation fiber and cable access solutions, including deployments with eight of the twelve largest cable operators in North America.

- Selected by Charter Communications to provide Entra ERM3 next-generation Remote PHY devices for this customer’s planned enterprise-wide hybrid fiber coax (HFC) network evolution. The Entra ERM3 RPD is expected to be used for a substantial portion of Charter’s network upgrade.

- Reached a major fiber milestone with a Tier 1 operator in the US, deploying more than 20,000 10G PON (Passive Optical Network) ports of Vecima’s Entra Fiber Access portfolio.

- Grew Vecima’s footprint in Europe with Entra R-PHY deployments at Telenet Belgium and Telenet Systems in Austria.

- In Asia, Kbro, Taiwan’s largest cable operator, selected Entra Remote PHY to enable high-speed DOCSIS 3.1 services to subscribers.

- California’s Orion Cable chose Vecima for an R-PHY solution tailored to smaller cable operators requiring a turnkey, cost-effective and future-proof path to DOCSIS 4.0.

- Demonstrated 10G-capable multi-gigabit symmetrical speed DOCSIS 4.0 in partnership with Charter Communications.

- Expanded PON portfolio with the launch of the Entra EXS1610 All-PON 10G shelf solution, which broadly supports widely deployed PON standards.

- Recognized by Dell’Oro Group as the 2022 market share leader in two key DAA categories: Remote Optical Line Terminals and Remote MACPHY.

Commercial Video (Terrace family)

- Generated full-year commercial video sales of $22.2 million, as compared to $29.8 million in fiscal 2022, and Q4 sales of $6.3 million, as compared to $8.8 million a year earlier, reflecting the transition to next-generation platforms and the impact of certain newer DAA-driven Commercial Video solutions being accounted for as part of Entra family sales.

- Achieved a new milestone with Terrace and TerraceQAM bulk video delivery reaching an estimated 25,000 hotels, enterprises and commercial sites.

- Completed lab qualification and first large operator deployment of TerraceIQ in an IPTV environment.

Content Delivery and Storage (CDS)

- Full-year CDS sales grew 20.3% to $52.3 million, from $43.5 million in fiscal 2022; achieved record fourth quarter CDS sales of $17.1 million, up 85.4% from $9.2 million in Q4 FY22.

- CDS services revenues increased 28.9% to $22.2 million in FY23 and grew 44.3% to $6.8 million in Q4.

- Undertook multiple IPTV expansions with existing customers in fiscal 2023, broadening network footprints to give larger subscriber bases access to state-of-the-art live, on-demand, and cloud DVR streaming services on the IPTV fabric, while further migrating from legacy QAM-based video services. These significant customer expansions of MediaScale IPTV subscriber coverage included:

-

- major footprint growth at a top 10 U.S. cable operator;

- a phase 2 buildout with a Tier 2 telecom provider in the U.S.;

- broadened IPTV deployment at a Tier 2 cable operator in the Midwestern U.S.;

- increased IPTV services capacity with a fiber service provider in the Southeastern U.S. where Vecima’s full MediaScale portfolio is used as the operator’s flagship video offering to households and multiple dwelling units;

- a major IPTV expansion with another top 10 U.S. cable operator; and

- network capacity growth for a leading fiber service provider covering several U.S. markets with a full suite of IPTV services in multi-tenant and multi-dwelling communities.

-

- Achieved an additional telco win for IPTV linear streaming, cloud DVR and Video on Demand (VOD) in fiscal 2023.

- Supported the record traffic experienced by operators during the FIFA World Cup Qatar 2022™ and again during Super Bowl LVII, while delivering 100% uptime performance.

- Established a partnership with Cadent, the largest independent platform for advanced TV advertising, to integrate Vecima’s MediaScale streaming solution with the Cadent Aperture platform. This integrated solution will enable service providers to protect existing linear ad revenue as they migrate to new IPTV platforms, while creating opportunities for incremental revenue.

Telematics

- Achieved best fiscal year to date for additions of new moveable asset customers, including 58 new customers for the NERO asset tracking platform and the addition of over 1,250 net new subscriptions. Asset tracking-related telematics subscriptions now represent approximately 17% of total subscriptions.

- Significantly increased the number of moveable assets being monitored to over 48,000 units, an over 280% increase in the last eight quarters.

- In the municipal government market for vehicle monitoring systems, continued roll-out with a Canadian municipality for approximately 100 vehicle subscriptions, including winter operations vehicles.

- Achieved record full-year and Q4 margins of 67.7% and 72.4%, respectively.

- Achieved record full-year sales of $6.1 million.

“As we move forward, Vecima’s outlook remains highly positive with cable service providers ramping up investment in next-generation DAA to protect and enhance their broadband competitiveness, while expanding their footprints,” added Mr. Kumar.

“Although we anticipate a slower-than-normal start to the year as operators complete current projects and fine tune rollout logistics, we are preparing to launch major DAA deployments with multiple customers in fiscal 2024. We anticipate a resurgence of Entra sales momentum in the second half and expect our quarterly run rate will reach a new high watermark by year-end, with more momentum to follow in fiscal 2025 and beyond.”

“In our Content, Delivery and Storage segment, demand for our IPTV and open caching solutions continues to build as existing IPTV customers undertake network expansions and new customers come on board. We anticipate low double-digit sales growth for the CDS segment in fiscal 2024 and continue to see robust future growth potential as IPTV gains momentum and our newer open caching solutions become an important driver of CDS performance.”

“Overall, we expect fiscal 2024 will bring a shift to much wider industry adoption of DAA and continued evolution to IPTV. Our years of investment and innovation have positioned us at the forefront of both markets and we are poised to reap the rewards,” concluded Mr. Kumar.

As previously reported, Vecima’s Board of Directors declared a quarterly dividend of $0.055 per share for the period. The dividend will be payable on November 6, 2023 to shareholders of record as at October 13, 2023.

CONFERENCE CALL

A conference call and live audio webcast will be held today, September 21, 2023 at 1 p.m. ET to discuss the Company’s fourth quarter and full-year end results. Vecima’s audited condensed annual consolidated financial statements and management’s discussion and analysis for the three months and year-ended June 30, 2023 are available under the Company’s profile at www.SEDAR.com, and at www.vecima.com/financials/.

To participate in the teleconference, dial 1-800-319-4610 or 1-604-638-9020. The webcast will be available in real time at http://services.choruscall.ca/links/vecima2023q4.html and will be archived on the Vecima website at https://vecima.com/investor-relations/earnings-call-archive/.

About Vecima Networks

Vecima Networks Inc. (TSX: VCM) is leading the global evolution to the multi-gigabit, content-rich networks of the future. Our talented people deliver future-ready software, services, and integrated platforms that power broadband and video streaming networks, monitor and manage transportation, and transform experiences in homes, businesses, and everywhere people connect. We help our customers evolve their networks with cloud-based solutions that deliver ground-breaking speed, superior video quality, and exciting new services to their subscribers. There is power in connectivity – it enables people, businesses, and communities to grow and thrive. Learn more at vecima.com.

Adjusted EBITDA and Adjusted Earnings Per Share

Adjusted EBITDA and Adjusted Earnings Per Share do not have a standardized meaning under IFRS and therefore may not be comparable to similar measures provided by other issuers. Accordingly, investors are cautioned that Adjusted EBITDA or Adjusted Earnings Per Share should not be construed as an alternative to net income, determined in accordance with IFRS, as an indicator of the Company’s financial performance or as a measure of its liquidity and cash flows. For a reconciliation of Adjusted EBITDA or Adjusted Earnings Per Share, investors should refer to Vecima’s Management’s Discussion and Analysis for the fourth quarter of fiscal 2023.

Forward-Looking Statements

This news release contains “forward-looking information” within the meaning of applicable securities laws. Forward-looking information is generally identifiable by use of the words “believes”, “may”, “plans”, “will”, “anticipates”, “intends”, “could”, “estimates”, “expects”, “forecasts”, “projects” and similar expressions, and the negative of such expressions. Forward-looking information in this news release includes the following statements: fiscal 2023 was an outstanding year for Vecima as we furthered our position as a leading innovator and essential partner supporting the global service provider industry’s wide-scale migration to distributed access architecture and IPTV; these developments underscore the growth of our partnership with one of the world’s largest cable operators as we together execute a broad network evolution strategy; our Entra ERM3 RPD is expected to be used for a substantial portion of Charter’s network upgrade; we established a partnership with the largest independent platform for advanced TV advertising that will enable service providers to protect existing linear ad revenue as they migrate to new IPTV platforms while creating opportunities for incremental revenue; as we move forward, Vecima’s outlook remains highly positive with cable service providers ramping up investment in next-generation DAA to protect and enhance their broadband competitiveness, while expanding their footprints; although we anticipate a slower-than-normal start to the year as operators complete current projects and fine tune rollout logistics, we are preparing to launch major DAA deployments with multiple customers in fiscal 2024; we anticipate a resurgence of Entra sales momentum in the second half and expect our quarterly run rate will reach a new high watermark by year-end, with more momentum to follow in fiscal 2025 and beyond; demand for our IPTV and open caching solutions continues to build as existing IPTV customers undertake network expansions and new customers come on board; we anticipate low double-digit sales growth for the CDS segment in fiscal 2024 and continue to see robust future growth potential as IPTV gains momentum and our newer open caching solutions become an important driver of CDS performance; overall, we expect fiscal 2024 will bring a shift to much wider industry adoption of DAA and continued evolution to IPTV; our years of investment and innovation have positioned us at the forefront of both markets and we are poised to reap the rewards.

A more complete discussion of the risks and uncertainties facing Vecima is disclosed under the heading “Risk Factors” in the Company’s most recently filed Annual Information Form, as well as the Company’s continuous disclosure filings with Canadian securities regulatory authorities available at www.sedar.com. All forward-looking information herein is qualified in its entirety by this cautionary statement, and Vecima disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events, or developments, except as required by law.

Vecima Networks

Investor Relations – 250-881-1982

Back to all Press Releases

Contact Investor Relations

Vecima Networks Inc.

201-771 Vanalman Avenue, Victoria, BC V8Z-3B8. Canada

Phone: (250) 881-1982 Fax: (250) 881-1974

Email: invest@vecima.com