Vecima Reports Q2 Fiscal 2021 Results

-

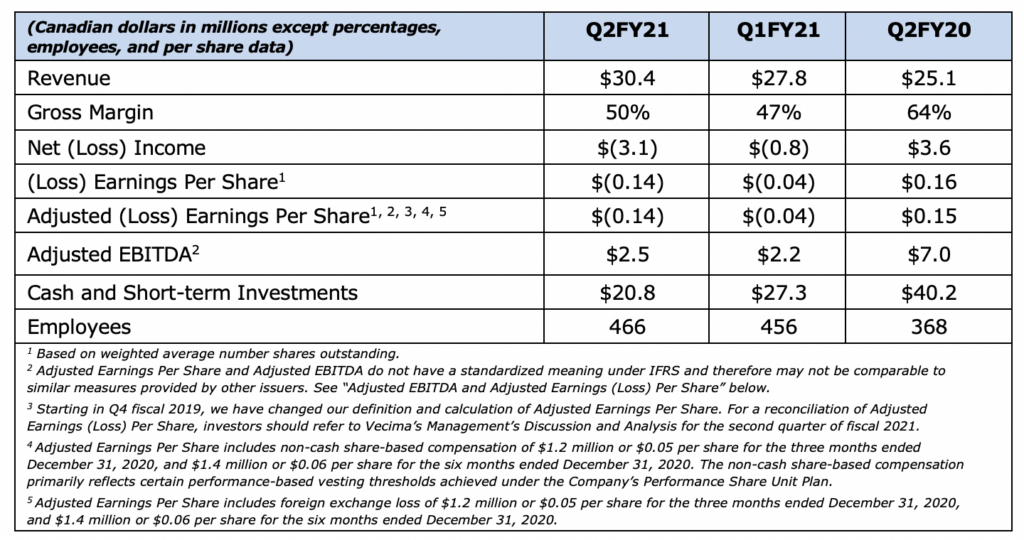

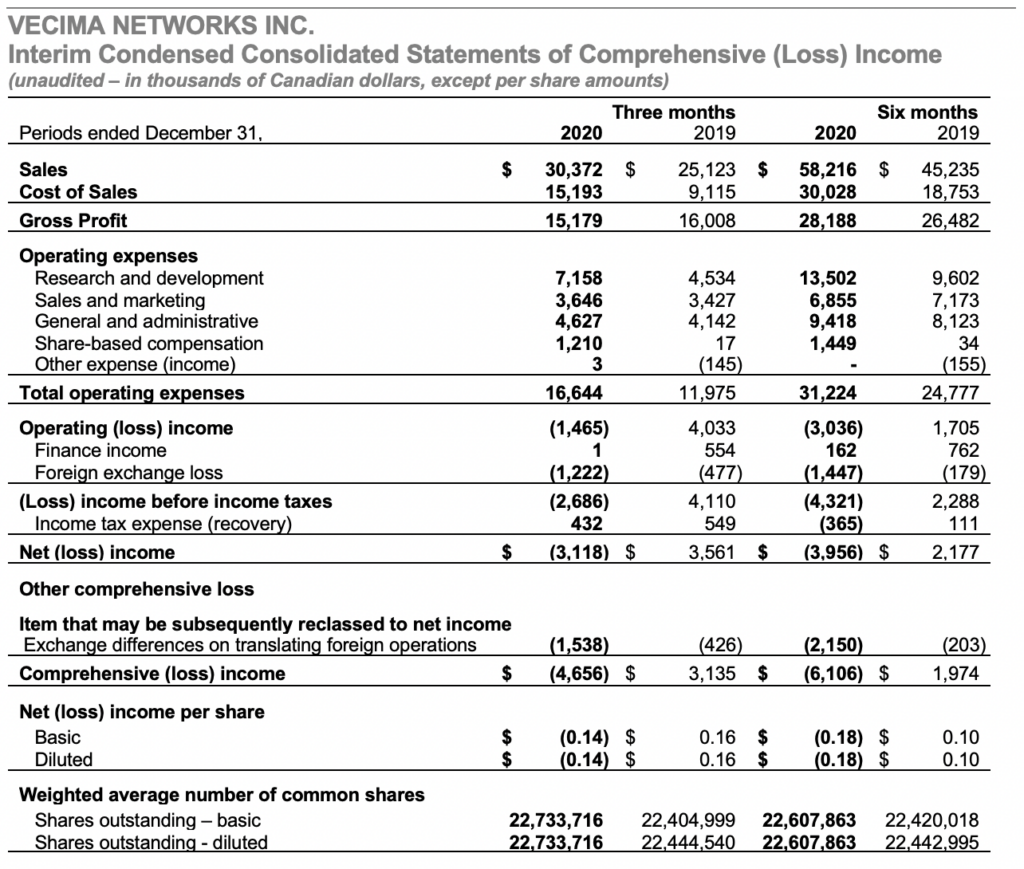

Revenue – $30.4M, Gross Margin – 50.0%, Cash Balance – $20.8M

-

Achieved record Q2 Entra sales of $8.0M, up $6.9M year-over-year and $2.8M quarter-over-quarter with multiple customers purchasing a wide array of products from Vecima’s combined DAA portfolio

-

Generated Adjusted EBITDA of $2.5M

-

Increased commercial video sales and secured first Tier 1 MSO order for next-generation TerraceIQ

VICTORIA, BC – (February 11, 2021) – Vecima Networks Inc. (TSX:VCM) today reported financial results for the three and six months ended December 31, 2020.

FINANCIAL HIGHLIGHTS

“Vecima’s sales climbed to $30.4 million in the second quarter, signifying rapid year-over-year growth of 21% as our next-generation technologies gained momentum,” said Sumit Kumar, Vecima’s President and Chief Executive Officer. “We paired our excellent sales performance with a gross profit of $15.2 million and adjusted EBITDA of $2.5 million, which we achieved despite a $1.2 million reduction of EBITDA from significant foreign exchange headwinds during the period and the addition of the first full quarter operating expenses from the acquired Nokia assets, which we continue to anticipate as EBITDA neutral on a first full-year operating basis.”

“Our top-line performance represented the best quarter in almost five years and was led by surging demand for our industry-leading portfolio of Entra Distributed Access Architecture (DAA) products. Entra sales accelerated to $8.0 million during the period, representing impressive sales growth of more than 6X year-over-year and 54% sequentially. Keep in mind that we are still in the very early stages of the DAA market. We see much more to come from Entra as current and additional customers transition to scale deployment as a broad set of MSOs initiate field deployments of DAA in response to both network capacity pressures and the larger trend of ramping access network bandwidth. Our customer engagements for Entra have now grown to 58 operators worldwide, and 24 of those customers have purchased DAA products for deployment from Vecima.”

Added Mr. Kumar, “Vecima’s second quarter sales momentum was further supported by robust demand for our commercial video products, particularly the TC600E, as operators continue to build out their MPEG 4 networks and a Tier 1 customer began associated densification. We also secured the first order, from a Tier 1 MSO, for our next-generation TerraceIQ hospitality industry platform and continued to see healthy demand for our legacy TerraceQAM platform where the entire widely-deployed population is upgradable to the new TerraceIQ when operators are ready.”

“In our Content Delivery and Storage segment we made important strides as we continued to consolidate the record customers wins of last year, secured an additional portfolio-wide IPTV customer, released multiple new product versions within our industry-leading MediaScaleX product family, and expanded service revenues and international sales,” added Mr. Kumar. “Across our business, we are addressing major market opportunities with technologies closely aligned to the needs of our global customers and laying the foundation for powerful growth.”

BUSINESS HIGHLIGHTS

Video and Broadband Solutions (VBS)

- The VBS segment delivered exceptional revenue growth of 98% year-over-year and 22% quarter-over-quarter, generating $16.5 million in sales as customers continued to transition to next-generation networks using Vecima’s platforms

DAA (Entra family)

- Deployments of next-generation Entra DAA products, with the industry only in the beginning phases of the DAA market, accelerated to $8.0 million in Q2, a 6X increase from $1.1 million in Q2 fiscal 2020 and up 54% from $5.2 million in Q1 fiscal 2021. Entra results for the quarter included $3.4 million of sales from the cable access portfolio acquired from Nokia in Q1FY2021. Sales from the acquired portfolio were $1.0 million in Q1 fiscal 2021.

- Production deployments of the industry-leading, multi-core interoperable Entra Remote PHY Node began ramping at the lead Tier 1 customer and deployment-related purchases were initiated at multiple additional MSOs in the second quarter. Combined with Entra Remote MAC-PHY Node and 10G EPON orders, Entra DAA platforms are now being sold to 24 operators on five continents

- Global customer engagements for Entra have expanded to include 58 MSOs, including operators in the US, Canada, CALA, EMEA and APAC. Over 40 operators across the globe are currently in lab trial, field trial, or live deployment phases

- Introduced new major software release for the Entra Remote MAC-PHY and DPoE/EPON Unified Cable Access Solution portfolio of products, enabling service providers worldwide to increase network scalability, performance, and upstream capacity

Commercial Video (Terrace family)

- Second quarter Terrace family sales grew 51% to $5.9 million from $3.9 million in Q2FY2020, supported by strong TC600E demand

- TerraceQAM sales remained on track for an excellent year with solid Q2 sales of $2.5 million following very strong Q1 sales of $4.2 million

- Achieved a significant milestone with launch of next-generation TerraceIQ system and delivered initial deployment orders to a new Tier 1 MSO customer

Content Delivery and Storage (CDS)

- Continued to consolidate the record new business wins of fiscal 2020, generating CDS sales of $12.5 million with service revenues hitting an all-time high and growing by 12% year-over-year

- Secured an additional IPTV customer win for the entire MediaScaleX portfolio, encompassing IP Linear, IP Video on Demand, and cloud DVR

- Won three new broadcast post-production customers for ContentAgent, Vecima’s video workflow management system

- Released multiple new product versions, adding significant new functionality in the areas of visual trick play, multi-tenancy, dynamic ad insertion, integration with additional partners, and support for new content formats

Telematics

- Increased engagement with municipal government customers with expansions adding 330 new subscribers

- Continued penetration in the moveable assets market with 190 new subscribers in the restoration and emergency medical services industries

Governance

- Cable industry veteran and 2020 Cable Hall of Fame Honoree, Mr. James Blackley, was elected to Vecima’s Board of Directors at the Company’s Annual General Meeting on December 7, 2020. Mr. Blackley brings extensive cable industry experience to the board, including senior management experience with both Charter Communications and Cablevision. Mr. Ben Colabrese stepped down as Director of the Board, having served since 2017 and having provided valuable contributions to Vecima during his tenure

“Fiscal 2021 is proving to be a breakout year for Vecima,” said Mr. Kumar. “The vast potential of the cable industry’s once-in-a-lifetime technology transition to DAA is materializing, and we are tapping into it broadly with the industry’s most comprehensive portfolio of distributed access solutions and the ability to address any and all of the potential DAA system architectures.”

“Simultaneously we are laying the groundwork for growth in our Content Delivery and Storage segment. While we continue to anticipate measured CDS sales growth in fiscal 2021, IPTV usage is increasing rapidly in households around the world and our MediaScaleX solutions enable operators to address this need. Vecima is uniquely positioned in the burgeoning markets for both cable access and IPTV, and our strategies are positioning us for significant growth,” said Mr. Kumar.

As previously reported, Vecima’s Board of Directors declared a quarterly dividend of $0.055 per share for the period. The dividend will be payable on March 29, 2021 to shareholders of record as at February 26, 2021.

CONFERENCE CALL

A conference call and live audio webcast will be held today, February 11, 2021 at 1 p.m. ET to discuss the Company’s second quarter results. Vecima’s unaudited interim condensed consolidated financial statements and management’s discussion and analysis for the three and six months ended December 31, 2020 are available under the Company’s profile at www.SEDAR.com, and at www.vecima.com/financials/.

To participate in the teleconference, dial 1-800-319-4610 or 1-604-638-9020. The webcast will be available in real time at http://services.choruscall.ca/links/vecima20210211.html and will be archived on the Vecima website at http://vecima.com/investor-relations/earnings-call-archive/

About Vecima Networks

Vecima Networks Inc. is a global leader focused on developing integrated hardware and scalable software solutions for broadband access, content delivery, and telematics. We enable the world’s leading innovators to advance, connect, entertain, and analyze. We build technologies that transform content delivery and storage, enable high‑capacity broadband network access, and streamline data analytics. For more information, please visit our website at www.vecima.com.

Adjusted EBITDA and Adjusted Earnings (Loss) Per Share

Adjusted EBITDA and Adjusted Earnings (Loss) Per Share do not have a standardized meaning under IFRS and therefore may not be comparable to similar measures provided by other issuers. Accordingly, investors are cautioned that Adjusted EBITDA or Adjusted Earnings (Loss) Per Share should not be construed as an alternative to net income, determined in accordance with IFRS, as an indicator of the Company’s financial performance or as a measure of its liquidity and cash flows. For a reconciliation of Adjusted EBITDA or Adjusted Earnings (Loss) Per Share, investors should refer to Vecima’s Management’s Discussion and Analysis for the second quarter of fiscal 2021.

Forward-Looking Statements

This news release contains “forward-looking information” within the meaning of applicable securities laws. Forward-looking information is generally identifiable by use of the words “believes”, “may”, “plans”, “will”, “anticipates”, “intends”, “could”, “estimates”, “expects”, “forecasts”, “projects” and similar expressions, and the negative of such expressions. Forward-looking information in this news release includes the following statements: Vecima’s sales climbed to $30.4 million in the second quarter, signifying rapid year-over-year growth of 21% as our next generation technologies gained momentum; we paired our excellent sales performance with a gross profit of $15.2 million and adjusted EBITDA of $2.5 million, which we achieved despite a $1.2 million reduction of EBITDA from significant foreign exchange headwinds during the period and the addition of the first full quarter operating expenses from the acquired Nokia assets, which we continue to anticipate as EBITDA neutral on a first full-year operating basis; our top-line performance represented the best quarter in almost five years and was led by surging demand for our industry-leading portfolio of Entra Distributed Access Architecture (DAA) products; keep in mind that we are still in the earliest stages of the DAA market; we see much more to come from Entra as current and additional customers transition to scale deployment as a broad set of MSOs initiate field deployments of DAA in response to both network capacity pressures and the larger trend of ramping access network bandwidth; across our business, we are addressing major market opportunities with technologies closely aligned to the needs of our global customers and laying the foundation for powerful growth; fiscal 2021 is proving to be a breakout year for Vecima; the vast potential of the cable industry’s once-in-a-lifetime technology transition to DAA is materializing, and we are tapping into it broadly with the industry’s most comprehensive portfolio of distributed access solutions and the ability to address any and all of the potential DAA system architectures; simultaneously we are laying the groundwork for growth in our Content Delivery and Storage segment; while we continue to anticipate measured CDS sales growth in fiscal 2021, IPTV usage is increasing rapidly in households around the world and our MediaScaleX solutions enable operators to address this need; and, Vecima is uniquely positioned in the burgeoning markets for both cable access and IPTV, and our strategies are positioning us for significant growth.

A more complete discussion of the risks and uncertainties facing Vecima is disclosed under the heading “Risk Factors” in the Company’s Annual Information Form dated September 24, 2020, as well as the Company’s continuous disclosure filings with Canadian securities regulatory authorities available at www.sedar.com. All forward-looking information herein is qualified in its entirety by this cautionary statement, and Vecima disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events or developments, except as required by law.

Vecima Networks

Investor Relations – 250-881-1982

invest@vecima.com

Back to all Press Releases

Contact Investor Relations

Vecima Networks Inc.

201-771 Vanalman Avenue, Victoria, BC V8Z-3B8. Canada

Phone: (250) 881-1982 Fax: (250) 881-1974

Email: invest@vecima.com